Like rollercoasters? Some love them, while others abhor them. As the old cliché goes, “different strokes for different folks.” Yet, we are all on the same rails to help achieve our personal goals, though oscillations can be tempered by diversification efforts.

The “it’s different this time” chant grows louder as volatility is prolonged. This chant is the Voldemort of the investing world (Harry Potter fans understand that reference). Why is “it’s different this time” admonished by professional investors? Let’s explore.

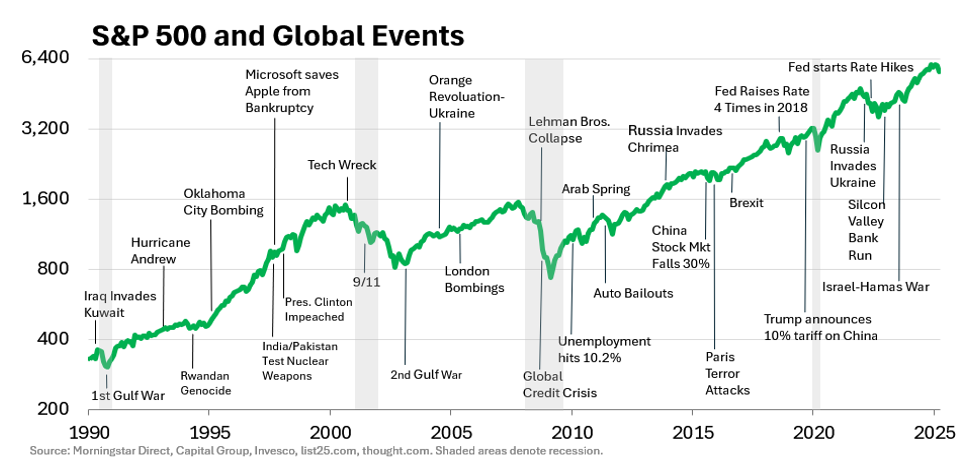

The term suggests a set of circumstances will cause a detrimental financial implosion to the likes we’ve never seen. This is the investment equivalent to “the sky is falling.” Sure, events that introduce uncertainty or even panic are unique. However, the market’s reaction follows a similar pattern. This leads to the cliché, “History may not repeat itself, but it does rhyme.”

Another way to think of market disruptions is with hurricanes. Each hurricane is different. The ocean temperature, atmospheric pressure, wind shear, and Coriolis all contribute to the formation, location, and strength of a hurricane. Each one is unique. Yet the outcomes are similar. Driving winds, significant rainfall, flooding, and damage. As with hurricanes, the severity and duration of market declines are unknown until the peril has passed. In the end, after the hurricane departs, plans for rebuilding and recovery follow.

Market-disrupting events, known or unforeseen, are the constant; periods of complete calm are unusual. Investing is often thought of as a way to grow your money. Investment professionals may define investing a bit differently. Investment professionals view investing as a risk assessment endeavor, taking smart risks with appreciation being a byproduct. Investment professionals understand that all risks cannot be avoided, but they do their best to avoid complete catastrophic failure.

When disruption occurs, it is good to remind yourself, “This will pass” — just like hurricanes.

Recent Comments