Inflation, Inflation, Inflation. That’s been the talk of the town for over three years. Inflation sprang from post-COVID supply chain disruptions as well as significant fiscal spending. Recall that the word “transient” was used to express inflation’s expected temporary path, similar to a hopeful corollary of COVID-19. Ultimately, the term was proven correct, just not at the pace many had hoped for.

When analyzing inflationary pressures, it makes sense to examine individual components. For example, early inflationary pressures originated from energy and goods as buying binges increased and re-starting energy plants took time. The next phase dealt with food, dining out, and travel. After buying binges satiated pent up demand, consumers focused on curing their cabin fever. Finally, the delayed effects of housing and rent kicked in. Which brings us to today.

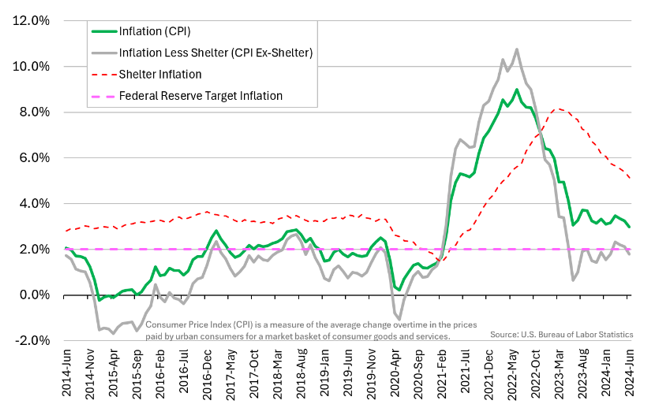

Inflation has seen a marked movement downward, much to our applause. A glance at the chart shows the ascent and descent of our travails. The green line is the reported broad inflation number, which includes all items. Last week’s release clocked in at 3.0%. A welcomed number. However, the grey line reflects inflation without the shelter component. It’s hard to fathom, but inflation ex-shelter has been hovering around the Federal Reserve’s (Fed) target rate of 2% for about a year! Admittedly, the Fed considers all items. The takeaway here is that the shelter component supports the inflation narrative.

The shelter is a large 36% weight of the inflation computation1, giving it a high impact. The largest portion is a number plucked from the air (i.e., a guess) called Owner’s Equivalent Rent (OER). OER makes up about 27% of inflation1 and the bulk of the shelter component. In short, OER is what a homeowner could expect to receive if they choose to rent their home. Sounds a little squishy. Not exactly a concrete number. Hardcore economists might have an issue with my characterization of “a guess,” as OER does rely on apartment rents and other items to form the basis for OER. But, at the end of the day, OER is not based on actual home rental transactions but a contrived estimate based on observable indirect expenses such as utilities and mortgages, as well as comparisons to apartment rent.

Another observation is the lagged effect or stickiness of shelter. Notice that shelter inflation (red dotted line) was slow to reflect the post-COVID upswing and slow to mirror the subsequent downswing. Much of this is the nature of the inputs, such as actual rents, which are often established 12 months hence, or utility payments not immediately tracking the fall in energy prices.

Diving a little deeper into inflation details can help policy makers with solutions and investment professionals with guidance. To most everyone else, it is inside baseball. Inflation is tangibly seen when buying groceries or a pair of socks. Though prices are higher than years past, prices should be stabilizing as inflation is really a measure of price changes. We hope you are enjoying your summer.

1Bueraeu of Labor Statistics, bls.gov

CRN-6797159-071624

Recent Comments