U.S. companies account for over 60% of the world’s stocks1! This may take many by surprise as foreign company formation due to expanding international trade has taken hold over the past 25-30 years. This is especially true for the decade leading up to the COVID pandemic. Shouldn’t international companies have a higher representation?

The broadest index of investable global public companies is the MSCI All Countries World Index (ACWI). The MSCI ACWI is considered the most complete index for global companies with approximately 9181 world constituents encompassing over 99% of the world’s equity investments2. To clarify, there are approximately 43,000 public companies3, however the vast majority are too small and/or illiquid for reasonable investment purposes.

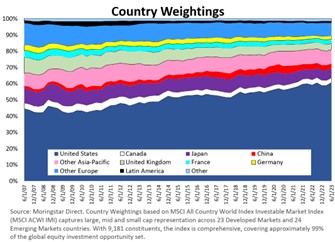

Upon the index’s inception, less than half (roughly 45%) of the investment opportunities existed within the U.S. borders1. The move to 60% weighting seems rather precarious given a progressively integrated global economy since 2007. Over the past 16 years, China has secured the global manufacturing top rank as many other countries have participated in globalization efforts, such as Mexico, Taiwan, South Korea, India, Philippines, to name a few. Logic would suggest the U.S. weight should have dropped. So, how could the U.S. have captured a higher capitalization while facing intensifying global integration?

The reason may not be as straightforward as one may think. First, stock markets provide a venue for investors to trade equity in public companies. Private companies are excluded. Second, world indices, such as the MSCI ACWI, include investable companies. Public companies that are too small or illiquid are not included in indices. Third and most importantly, indices’ construction favors larger companies’ stock performance. Hence, incredibly massive companies such as Apple ($3 Trillion value) have more influence than small companies, such as Isracard, Ltd. an Israeli credit card and loan services company.

Over the past 15 years, U.S. stocks have attracted investment dollars, pushing up the U.S. stocks prices and their accompanying indices. Back in 2007, Apple was valued at only $174 Billion4 (still a large company by any measure). Apple’s ascent to the world’s largest company equates to a 17x increase since 2007. Similar stats can be said for Microsoft, Amazon, Alphabet (a.k.a. Google), or Tesla. All are American companies.

U.S. versus international stock outperformance tend to move in cycles. The last 15-16 years have witnessed an unprecedented preference for U.S. stocks. The next 10-15 years may not be as lopsided. Having exposure to international companies may be beneficial to investors. The commencement of August means back-to-school sales are around the corner. Time to start thinking of returning to normal schedules.

1Source: Morningstar Direct; MSCI All Country World Index (ACWI)

2MSCI; https://www.msci.com/documents/10199/4211cc4b-453d-4b0a-a6a7-51d36472a703

3World Bank

4https://companiesmarketcap.com/apple/marketcap

CRN-5852499-080223

Recent Comments