The sound of sleigh bells jingling might make you feel merry during this holiday season, but can that joy translate to positive investment market returns? So goes the “Santa Claus Rally” theory, coined by Yale Hirsch, founder of the Stock Trader’s Almanac, in 1972.

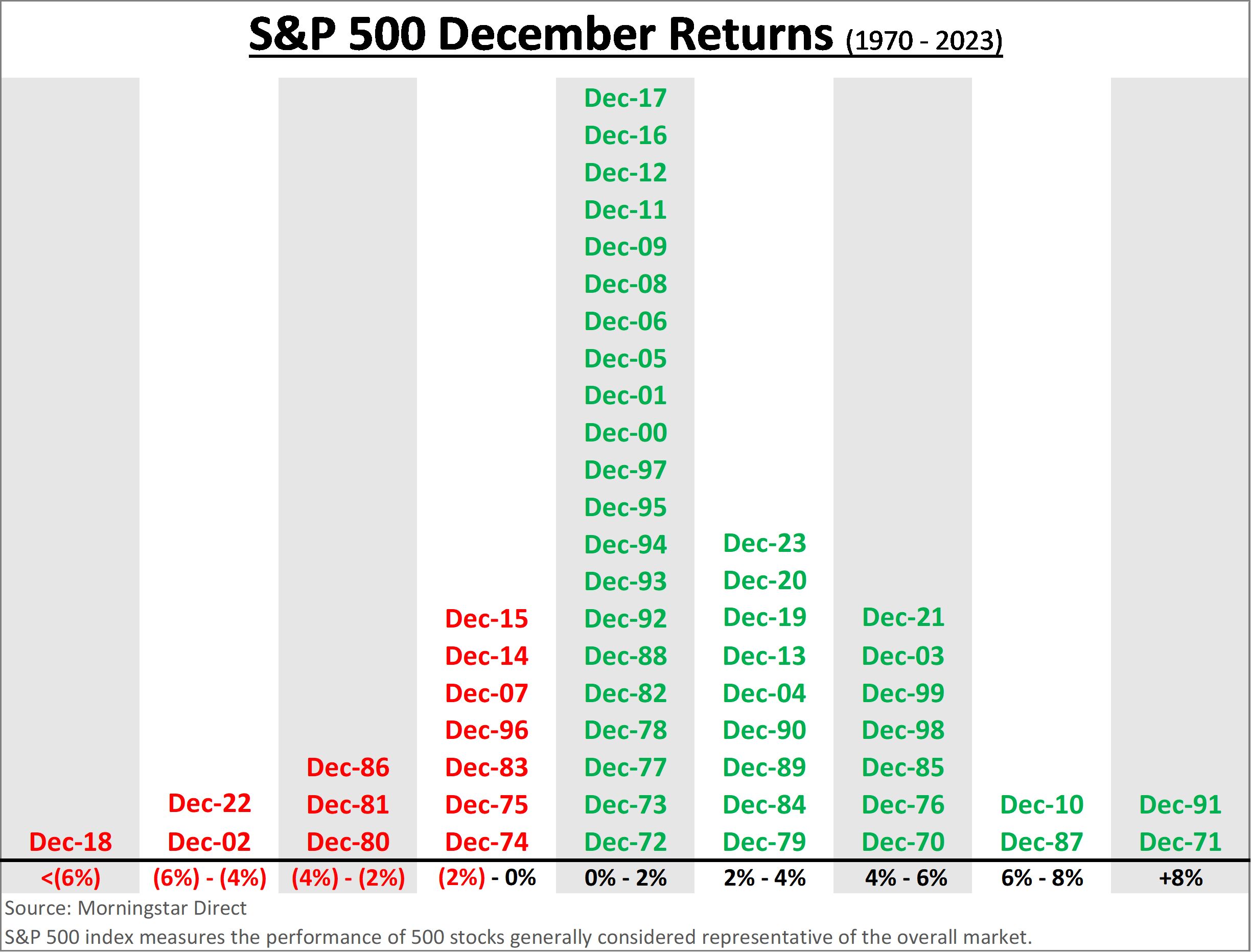

We first wrote to you on the Santa Claus Rally last year, presenting the interesting phenomenon in which the S&P 500 has experienced positive returns in 76% of Decembers since 19701. Following that letter, Santa visited investors again, with yet another positive

December return of 4.42%1. So, what’s happening here?

Try as they might, researchers have not been able to define a cause for the Santa Claus Rally phenomenon. Theories range from seasonal psychological excitement to low trading volume during the holidays, making it easier to move the market in a positive direction. As we often remark in our letters, financial markets are not driven solely by singular events; rather, they are guided by a multitude of factors. Although, singular events occasionally have a more outsized effect on the markets than historically suggested.

The best Santa Claus Rally occurred in 1991 with a return on 11.4%1, which was complemented by the USSR President Gorbachev’s resignation, the dissolution of the USSR, end of the decades long Cold War, and “peace dividend” declarations. Other Santa Claus Rallies can be partially attributed to pandemic relief (2020), the dot-com bubble coupled with Y2K build out (1999), and interest rate cuts (1991).

You have often heard us opine that uncertainty is the market’s kryptonite. Many of the aforementioned rallies were pushed higher by the ending of uncertainty in one way or another. The ending of a war and government stimulus are both certain events that give investors reason to celebrate. On the other hand, events with uncertain outcomes, such as trade wars and indicators of economic weakness (2018) or inflation and supply chain issues (2022), give investors reason to pause and rethink their expectations.

Although we may never be able to determine a singular cause of the Santa Claus Rally, we know that one month represents a short-term blip in your investment horizon. The success of your financial plan is dependent on a long-term, disciplined approach to investing, not short-term swings in the market. Whatever Santa may bring for us in 2024, know that we will be here to help guide you through it.

CRN-7408783-120424

Recent Comments