Some of you may be old enough to recall waiting in line Friday afternoon to deposit your paycheck. You may also remember bankers’ hours, with many banks closing at 3 pm. That was a time before the technological advances of Automated Teller Machines (ATMs) enabling almost 24/7 banking, provided your willingness to visit a bank branch. ATMs have since been replaced by mobile banking, 24-hour banking without a physical bank branch.

The banking story is a tale of two experiences. The first is the convenience and efficiency mainly afforded to bank consumers, i.e., depositors. The other side of the coin is people losing their jobs. Over time there were diminished needs for in-person banking interactions, reducing per-capita bank tellers and isolating teller duties to higher-level functions. The 25-year transition sounds like a long time; however, from a historical perspective, two industry-shattering phases in 25 years is considered quick.

The next societal automation change will make the teller transformation look like a slow-moving sloth and impact countless professions. That’s right; I’m talking about Artificial Intelligence (AI). Technological innovation has advanced so much that you may not realize some of your assumed personnel interactions were actually with a computer. Star Trek fans remember Captain Kirk and other USS Enterprise officers conversing with the ship’s computer just like another crew member. Those days are closer than you think.

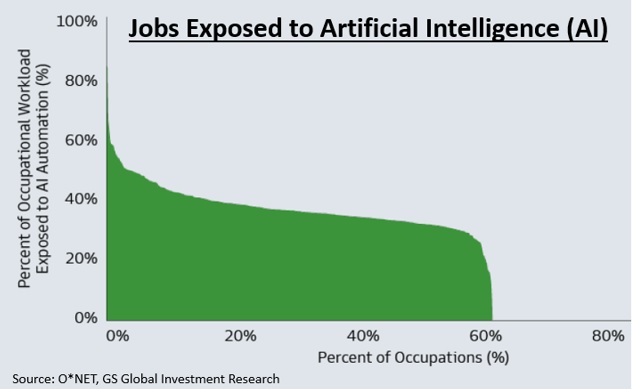

Recent analysis from Goldman Sachs has estimated about two-thirds of occupations are exposed to some degree of AI automation1. Be careful assuming which jobs are affected as the list is growing; account/bookkeeping/tax prep, writers/editors, interpreters/translators, programmers, remote customer service reps (call centers), reporters, teachers, and routine surgeons, to name a few. Generally, jobs that require repetitive tasks, some level of data analysis, and routine decision-making were found to face the highest risk of exposure. Those least affected are likely to be professions based on individual effort and creativity (i.e., athletes, artisans, mechanics, entrepreneurs) as well as high-level or visionary thinking (i.e., scientists, engineers, company management).

Not all is bad. Over the last 80 years, the technology-driven creation of new jobs has accounted for 85% of employment growth1. In essence, utilizing technology and automation for more mundane human tasks avails the opportunity for societal progress via higher-level problem-solving, not to mention extended leisure time. Further, the development and deployment of technology has traditionally led to higher economic growth and greater productivity. Goldman has highlighted enhanced global economic growth due to AI1.

Secular trends are often slow to implement in the near term but impactful in the long term. AI is undoubtedly the next secular trend, which may occur more quickly than past transformations. Hence, there are investment implications to be conscious of.

1 https://www.goldmansachs.com/intelligence/pages/generative-ai-could-raise-global-gdp-by-7-percent.html

CRN-5762329-062023

Recent Comments