We’ve come a long way in just 12 months. It’s hard to believe June 2022 clocked in the highest inflation measure in four decades! The Great Inflation period (1965 to 1981)1 included two floggings of double-digit inflation. This go-around, high inflation lasted about a year and never entered the double-digit realm. The lessons of the 1970s, though painful, crafted the direction taken over the past 16 months.

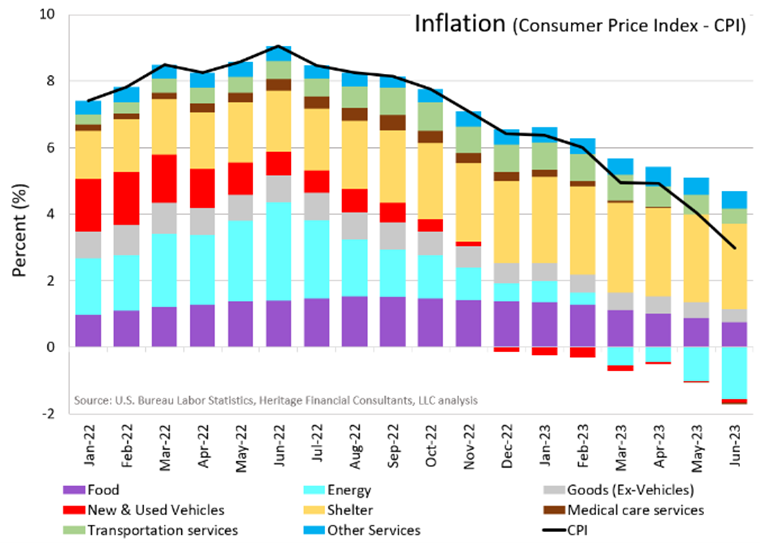

June 2023 inflation released last week indicated much progress has been made. The accompanying chart has identified select components representing how they have affected inflation. The black line is overall inflation.

The overall theme is falling inflation since its peak in June 2022. Upon closer inspection, certain aspects have contributed or detracted from inflation. Here are a few notables.

.

- Food (purple) inflation has been creeping lower since its peak in August-September 2022.

- The operative word is “creeping” adding to “sticky” inflation.

2. Energy (turquoise) previously a major contributor has now become a detractor in recent months.

- Admittedly, energy is notoriously unpredictable.

3. New and used vehicles (red) prices were all the rage in early 2022 with empty lots.

- Some of the car shortage was due to the semiconductor chip shortage as modern cars require copious amounts of computing hardware. Resolved chip shortage solved the car shortage.

4. Goods (grey) inflation is more muted as consumers have shifted their spending to services.

5. Housing (yellow) has a large footprint and remains high. However, embedded in housing costs is a lagged effect as higher rents from last year are still priced in current lease contracts. Most leases are for 12 months or longer.

- The lagged effect automatically contributes to “sticky” inflation.

6. Medical Services (brown) has effectively evaporated.

7. Transportation Services (green), which includes car repairs and car insurance, has ticked up recently.

- This “sticky” inflation is directly and indirectly related to higher car prices as people choose to repair older cars while insurance premiums rise.

Fighting the inflation goliath has not been easy, not to mention, it’s too early to claim victory. Yet, clear strides have been made in a short time. There is an economic saying, “high prices cure high prices.” In other words, high prices will sooner or later curb demand, ultimately lowering inflation. Some of the sticky inflation aspects still have to be rung out, but it is clear we are on the right path. It’s hard to believe the summer is half over. Be sure to make the most of the second half.

1 U.S. Bureau of Labor Statistics, bls.gov

CRN-5809405-071423

Recent Comments