They’re Baaack! Financial journalists have a way with words. During the COVID rebound, the acronym “FAANGM” became popular referring to the main six stocks driving the stock market performance. Lack of FAANGM exposure led to perceived sub-par results. The latest term, “Magnificent Seven,” has sprouted legs. Should financial journalists be nominated for a Pulitzer Prize?

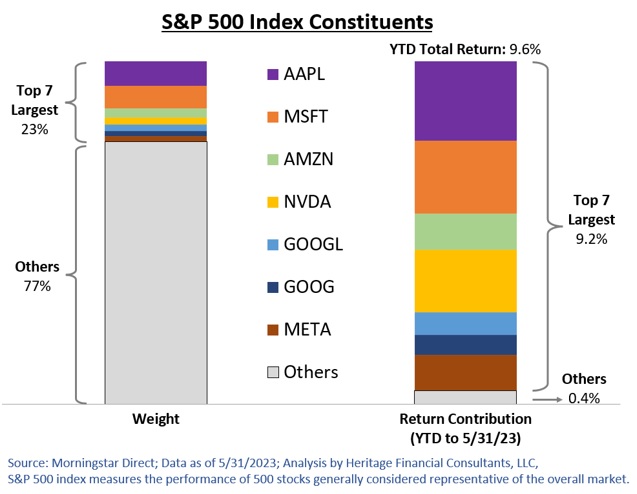

The Magnificent Seven refers to the seven stocks driving the stock market’s performance through May 2023. The Magnificent Seven are similar to the FAANGM stocks of 2021 referring to Facebook (formally known as Meta), Apple, Amazon, Google (formally known as Alphabet) and Microsoft. Netflix has been replaced with another “N” company, Nvidia. Google has two share classes, so the six companies total seven stocks. These seven stocks account for close to 23% of the S&P 500 weighting but have created the lion’s share of the S&P 500 returns through May. The remaining 494 companies account for a scant 0.4% to date.

Such market concentration can deliver a different picture than what is actually occurring. In fact, more value-oriented equity classes are in the red so far this year. The S&P 500 is one of the most widely monitored indices. It is often quoted during the evening news and presented on countless websites. Without querying for performance concentration, it would be difficult to ascertain just how influential the Magnificent Seven are. The cause of such performance concentration seems to be uncertainty mitigation, such as, Debt Ceiling resolution, retreating inflation, and interest rate stabilization.

Diversification is the primary tenet of investment portfolios. The purpose of a well-diversified portfolio is to mitigate investment specific risks, asset class risks or other unsystematic risks. Seven mega-cap Big Tech stocks would hardly pass muster. The interesting thing about risk is it often presents itself suddenly. Risk is not always realized until it is too late.

Diversified portfolios may appear to lag during periods of performance concentration. The reality is diversified portfolios are trekking through the risk maze with the aim of favorable risk-adjusted performance. It is often said there is always something to dislike in a diversified portfolio.

As your wise grandmother might have mentioned, don’t put all your eggs in one basket. Though diversification can sometimes appear dull and boring, we have found diversification to be sage portfolio design. Enjoy your weekend.

CRN-5725465-060723

Recent Comments