One cause of the decline was irrational exuberance. It is not uncommon for a trend to go viral, attracting investing interest and accompanying dollars. Those investment dollars can bid up stock prices to unsustainable levels. Ultimately, high valuations will seek more reasonable grounds. Hence, be wary of the hot dot investing as you never know when viral interest wanes.

Of further interest is a recent report from the International Energy Agency (IEA)1. In a few short years, the IEA expects AI, cryptocurrencies, and the data center’s electricity demand to double, which is equivalent to Japan’s electricity consumption. That is just the beginning. Here’s an interesting statistic, ChatGPT AI queries require 10 times the electricity of a simple Google search1. Think of the electricity needs if all internet searches became AI based searches, a focus of Silicon Valley tech companies! The amount of electricity would be logarithmically astronomical.

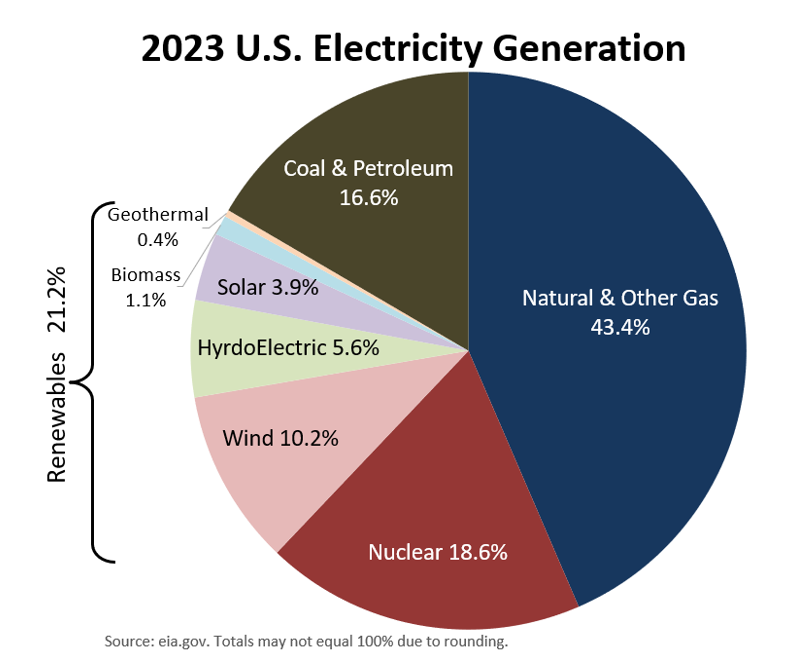

Such electricity needs do require examination of the electric grid. Projecting the estimates from the IEA study onto the U.S. grid leaves much to the imagination. Where is this electricity going to come from? Power plant construction is not an overnight undertaking. It takes years for property acquisition, permitting, and actual plant construction. Renewable electricity sources have grown significantly in recent years (especially wind and solar), but they are a long way from fully representing the current supply of electricity, let alone large extra demand from AI, cryptocurrencies, and data centers. Don’t forget about the additional need from EVs and other electrification goals.

The U.S. has made great strides in reducing power plant emissions. Though, this was mostly derived from converting coal fired power plants to natural gas fired power plants, a higher emissions polluter to a lower emissions emitter. But the fact remains, the bulk of electricity supply comes from fossil fuels.

AI, crypto, EVs, robotics, and electrification are all the rage with good reason. It is hard to argue against the future. Interested investors should be mindful of all trends’ risks and not become hypnotized by the extolled opportunities. Risks come in the form of fundamental challenges as well as investor exuberance.

1https://www.iea.org/reports/electricity-2024

The information provided here is for general informational purposes only and should not be considered an individualized recommendation.

CRN-6845444-073024

Recent Comments