The bond future is… rosy! Investment professionals making profound statements about the future is like Harry Potter saying Voldemort, it’s verboten. With our compliance folks reaching for the valium, it must be said that no one has a crystal ball into the future and any conjecture may not be realized. With that out of the way, let’s review data that could support such as a statement.

Asset allocation modeling requires a certain set of inputs. These include return and risk assumptions. For each asset class, a set of variables need to be distilled into forward looking return and risk estimates to help determine how much of one’s portfolio will be exposed to each asset class. To be clear, return and risk estimates are not supposed to be concrete forecasts, just reasonable assumptions over the course of the business cycle. It is a time consuming and arduous task.

Total returns are the sum of two primary components, yield and appreciation. For example, if an asset is yielding 2% and the underlying asset grew by 5%, the total return is 7%. Simple math at this level. Arriving at yield and appreciation assumptions is where the intricacy resides.

Generally, the yield component tends to be the largest factor for bonds. The appreciation tends to be subject to cyclical business risks, value-add of a bond manager (i.e., bond selection), or extemporaneous circumstances (such as the ’08-’09 Credit Crisis or COVID). As such, yield analysis commands significant attention for bond assumptions.

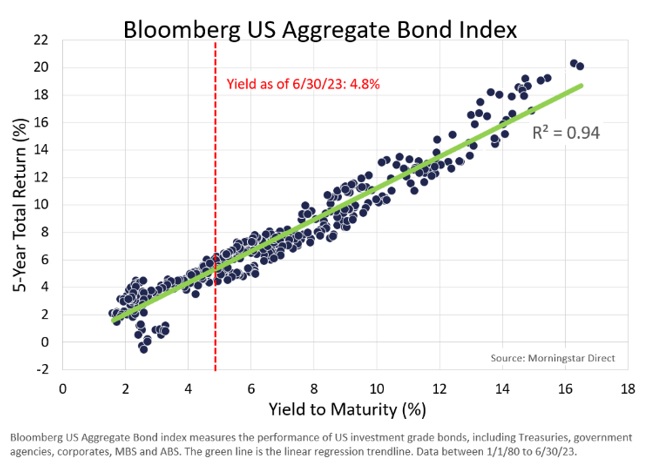

Here’s where the interesting part comes in. Recall, return assumptions are not near-casts or forecasts over the coming months and quarters. Largely, return assumptions are calculations over a multiyear period, say five or ten years. When comparing historical yields with the subsequent five-year or even ten-year returns, one will find an extremely high statistical relationship at almost a one-for-one basis. Meaning, a starting yield of 5% should result in a total return of about 5%.

.

Back to the initial statement, “The bond future is… rosy!” As of June 30th, the Bloomberg US Aggregate Bond Index was yielded about 4.8%1. If the next five to ten years maintains the same relationship established over decades, investment grade bonds should generate a total return around 4.8% making bonds an attractive investment asset. Not to mention, the higher yields should act as a better shock absorber to stock volatility.

Admittedly, predicting the future returns of any asset is extremely challenging while no historical period repeats itself. Yet, bond yields predicting bond long-term total returns has been pretty consistent over time. Hope you are enjoying the summer with family and friends.

1Morningstar Direct

CRN-5803766-071223

Recent Comments