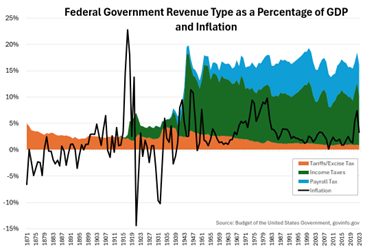

Do tariffs equate to inflation? It’s complicated. You might be surprised at the answer. The historical evidence does not share the media’s sensationalism.

Tariffs are not a new phenomenon. In fact, tariffs have been around longer than income and payroll taxes. Tariffs were the primary federal government revenue stream until 1913 with the passage of the 16th Amendment1. Payroll taxes were introduced during the Great

Depression to fund Social Security, providing a social safety net.

Tariffs are designed to make foreign goods and services more expensive, encouraging domestically produced goods and services. On the surface, this sounds like inflation via higher prices on tariffed foreign products or a shift to higher-priced domestic goods. To some degree, this logic is sound. However, the world is far more dynamic than a binary choice. The market of goods and services includes competition (think different TV makers. At the end of the day, a TV is a TV), substitute goods (think transportation via car, motorcycle/scooter, bicycle, public transport, taxi/uber, etc.), or foregoing purchases all together (think postponing a car, computer, or clothing purchase).

A bit of history. 2002 steel tariffs resulted in steel inflation for the first nine months of 20022. Clear evidence that tariffs resulted in a one-time price increase, not ongoing inflation. The market adjusted to a supply shortfall, similar to the COVID supply chain effects that we lived through a couple of years ago. 2009 tire tariffs initially seemed to result in higher prices. However, a deeper dive reveals the higher prices were due to errant weather flooding in Thailand and halting rubber tapping2. (Thailand accounted for 31% of global rubber supplies.2) 2018 Chinese pork tariffs were followed by a global drop in pork prices2. In short, the Chinese tariffs resulted in lower global pork demand, which raised pork stockpiles and resulted in falling pork prices.

By focusing on sophomoric one-step tariff analysis, the media missed a great opportunity to discuss international trade policy. Tariffs are most often proposed to thwart unfair trade practices. In other words, the threat of tariffs is used as a negotiation tactic. In 2020, the U.S. threatened wine tariffs to counteract France’s “digital services tax,” targeting U.S. technology companies3. After careful consideration, France decided not to proceed with their “digital services tax” resulting in no tariff or tax being applied on either side.

On the surface, tariff-induced inflation seems logical. The reality is the tariff/inflation dynamic is mixed. Extrapolating tariff effects in a fluid environment makes for a simplistic inference. The nature of economics is its everchanging dynamism. As difficult as it is, prognosticators need to consider all factors, the environment in which they are being proposed, and varied possible outcomes.

CRN-7455365-121824

Recent Comments