Six Months. Six more months before we get to pull the lever in the voting booth. That also means six more months of election media chatter.

Politics seem to have become more passionate over the past 10-15 years. There’s probably a PhD dissertation that can identify the relevant sociological catalysts. The forthcoming media blitz may persuade or galvanize your inclinations. Though powerful emotions can take hold, investors should be wary not to let their emotions supplant their investment objectives. Financial markets are influenced by far more than the White House resident.

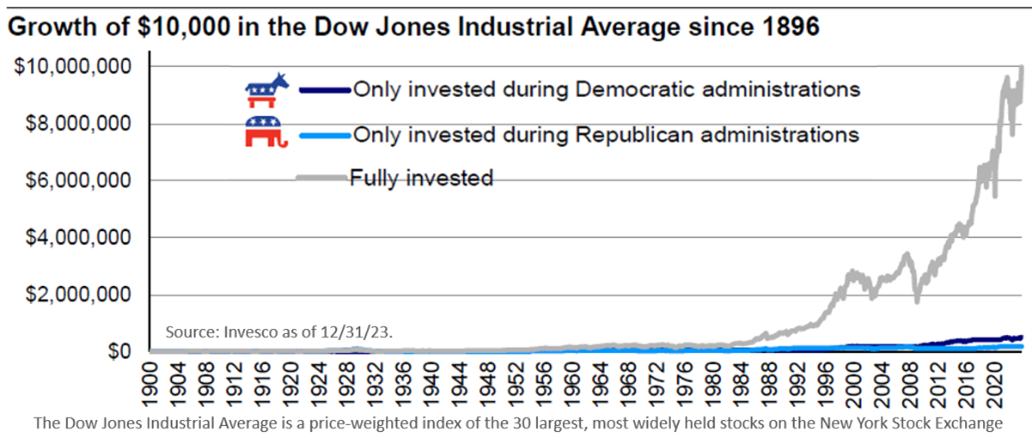

As the campaign trail rhetoric builds, it’s important not to let political preferences contaminate your portfolio. Your portfolio is not intended to shift based on which administration prevails. Investment portfolios are built to endure economic factors, business fluctuations, and fluid market dynamics, addressing personal goals irrespective of the candidate with the highest voting tally.

Neither party can claim the economic victor or the investing champ. Both parties have had their share of winning and losing administrations. Upon closer examination, period specific circumstances are far more influential than the White House occupant, for example, WWII, global financial crisis or a worldwide pandemic were more influential than the policies put forth by either administration.

Mature developed economies are purposefully designed not to be re-engineered with the changing guard. Fiscal budgets intentionally do not overlap with elections and inaugurations. Policy enactment often takes months and years of debate before being voted on, which still may not pass. If passed, new policy is typically phased, giving the populace and business time to adjust. Perfect examples are the most recent fiscal spending plans of the Infrastructure Act (passed in 2021), CHIPS Act (passed in 2022), and the Inflation Reduction Act (passed in 2022) with spending being deployed over the many future years1.

What does matter? Federal Reserve crafted monetary policy is far more important. This is why financial markets have been so focused on the Fed’s action over the past few years. Further, ingenuity, business opportunity, and cost control are what attracts investor interest. Think of how tablets, work-from-home, and rideshare apps have improved your life while also improving your wallet. After all, saving and investing is about getting your money to work for you.

As we move through the coming months, it’s a good idea to separate our personal political leanings from our financial blessings. It’s very tempting to equate economic progress with immediate political change. However, slow-moving policy change purposefully mitigates administration risk.

1 Congress.gov Past performance is no guarantee of future results.

CRN-6573684-042324

Recent Comments