Alternative investments have picked up in popularity in recent years as investors have explored ways to diversify from more typical stocks and bonds. In addition to diversification benefits, alternatives can offer exposure to different opportunities. As with all investment choices, alternatives possess their own idiosyncrasies investors should be aware of.

Alternatives cover a wide range of investments that are not classified as purely stocks, bonds, or cash. Alternatives can include non-traditional investment markets (such as private equity, private debt, managed futures, etc.) or trading strategies of traditional stock and bond markets. Alternatives can come in different vehicles including highly regulated mutual funds or lowly regulated private partnerships.

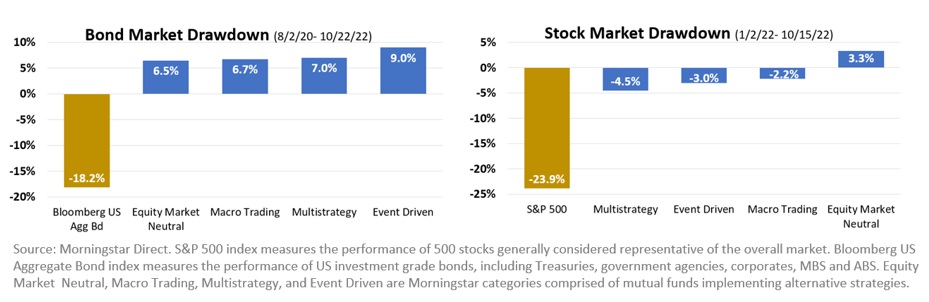

The key benefit to alternatives is diversification. Alternatives can reduce overall portfolio volatility via mitigated stock and bond correlations. From the lens of portfolio design and construction, combining securities or asset classes that are not perfectly correlated can arise in enhanced risk-adjusted returns, which is the ultimate objective of asset allocated portfolios. Due to the non-traditional or the active trading strategies, alternatives tend to moderate returns, especially during traditional market declines.

Alternatives are not perfect. As with all investments, each alternative has its own shortcomings and constraints. Private vehicles often require minimum investor suitability standards, liquidity restrictions, and abundant stewardship due diligence. The mutual fund variants mostly solve such constraints, however mutual fund options are relegated to liquid trading strategies reducing possible non-traditional opportunities.

The pros and cons of alternatives have been debated by practitioners and academics alike. It’s our experience that personal bias plays a heavy roll on either side. As portfolio architects, we try to keep an open mind about the role of alternatives and how they might benefit clients’ portfolios. Staying apprised of academic arguments as well as practical implications help us build more comprehensive portfolios to benefit our clients.

CRN-6414809-022124

Recent Comments