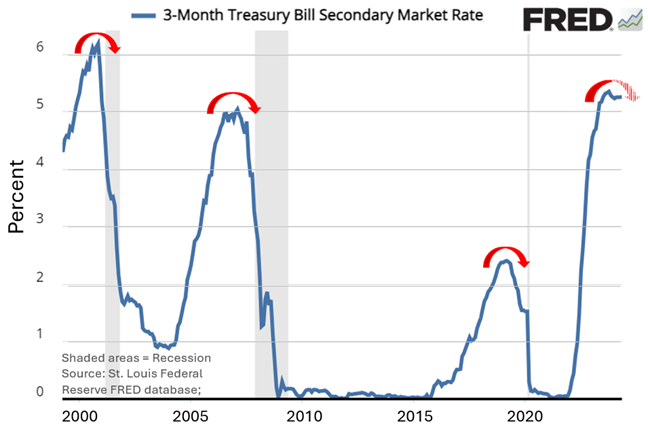

The Federal Reserve (Fed) has been teasing a rate cut since late 2023. So far, the Fed has not carried through with its promise. It’s fair to say it’s a matter of “when” and not “if.” The Fed uses interest rate policy as its primary tool to foster its two objectives: maximum employment with stable prices. A review of the Fed’s past should leave no surprises; a cutting cycle has always followed a raised cycle. Since cash yields are based on the interest rate set by the Fed, cash yields will ultimately fall.

The Fed’s yo-yo remarks have not helped matters. The Fed’s attempt to clarify the timing and degree of future rate cuts has been as clear as mud, leaving financial markets to their own devices. Financial markets have fluctuated estimates between 1 and 7 rate cuts for 2024, with the current guess of two rate cuts by the end of the year1. The Fed’s shifting position has contributed to recent volatility.

It is important to note investors could be influenced by their own psychology. Recency Bias is a cognitive bias that favors recent events over historic ones. In other words, despite compelling evidence that cash yields tend to be very low and rollover after they peak, investors favor cash assets due to the 5% yields experienced over the past year.

One must set aside one’s psychological biases and examine the backdrop. Cash yields will trend down at some point. Sidelined cash must go somewhere, likely income generating securities such as stocks and bonds. Weakening economic data could give investors reason to prefer more secure assets over more risky assets. Falling interest rates would bode well for bond returns as bond prices are inversely related to yields.

Calling the exact top or bottom is next to impossible. Savers and cash investors will need to confront the inevitable… cash yields cannot remain at current levels. Prudent investment management would suggest the time has come to reevaluate excess cash hordes. We hope you enjoyed your July 4th.

CRN-6756346-070224

Recent Comments