Many may not realize it, but we are our own worst enemy. Our brain, its chemistry, and its reactions were developed over eons to respond swiftly with minimal rational contemplation. Our personal survival depended on this adrenaline filled fight or flight response.

Modern financial markets are about 150 years old—hardly enough time for our brain chemistry to evolve into pure logical and reasoning computers. In fact, it’s the emotional reaction to news and information that causes much of the market’s volatility. As such, recognizing our innate emotional triggers can help us become better investors.

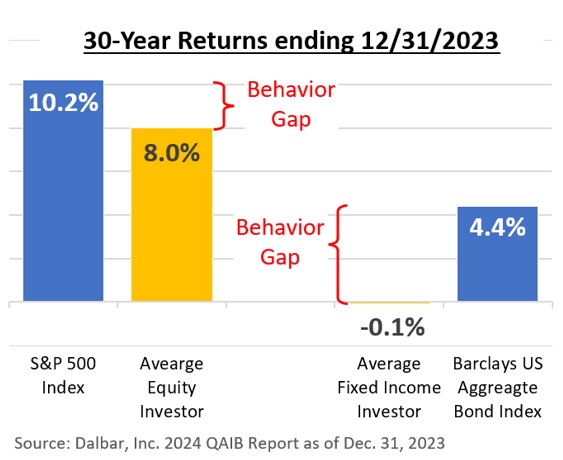

Research done by Dalbar, Inc., a company that studies investor behavior and analyzes investor market returns, consistently shows that the average investor earns below-average returns. For the 30 years ending December 31, 2023, the S&P 500 Index averaged 10.2% a year. The average equity fund investor earned a market return of only 8.0%1.

Dalbar, Inc. and other academics found investor behavior is illogical and often emotionally based. This does not lead to wise long-term investing decisions. Some of the more common mistakes are:

- Buying High (usually AFTER a market/stock advance),

- Overreacting During Times of Uncertainty (things are rarely as bad as they seem),

- Overconfidence (investors exaggerate their ability to predict the future).

The intersection of psychology and investing has developed into a field of study often referred to as Behavioral Finance. We may not be able to fully overcome our natural tendencies, however being aware of them and their triggers should help mitigate poor decisions. Sensationalized negativity (perfected by media) keeps our minds in a state of anxiety limiting blood flow to the brain’s logical thinking center, the frontal cortex. The media does what it needs to sell advertisements to its audience.

Here are three key takeaways to avoid being an average investor.

- Temper your enthusiasm during good times.

- Become more optimistic when things look bad.

- Be aware of external provocations offering jaded perspectives.

- Stick to your plan.

Vanguard has developed a white paper series titled Advisor’s Alpha2. Advisor’s Alpha presents research and evidence of our emotional proclivities and ways to overcome them. Additionally, Vanguard reviews tactics employed by financial advisors to better your probability of success and reduce being your own worst enemy.

S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Bloomberg US Aggregate Bond index measures the performance of US investment grade bonds, including Treasuries, government agencies, corporates, MBS and ABS.

1 https://www.dalbar.com/

2 https://advisors.vanguard.com/advisors-alpha

CRN-6653404-052924

Recent Comments