Markets go up… until they don’t. I know, revolutionary insight. Another momentum cliché is, “the trend is your friend.” Momentum investing is just what it sounds like: the market’s momentum has enough strength to transcend perceived risks. The only thing that can stop momentum is its own fatigue.

Since October 1st, 2023, investors have had a front row seat to momentum investing. Equity markets trended higher, irrespective of cautionary remarks, geopolitical tensions, or mixed economic data. Just buy, buy, buy. The problem with momentum investing is the momentum will fade, the buying will stop, and a reversion to sound investing principles will return. Momentum surges are difficult to time as their inception and finale are never broadcast and always end in a pullback. That is what has happened over the past 2-3 weeks as the previous quarters’ momentum petered out, allowing reality to gain traction.

One of the worst aspects of momentum is investor conditioning. Unhindered upward trending markets condition investors to expect higher highs only to be surprised when the inevitable reversal happens. Eventually, fearful alertness consumes one’s mind with perceived threats, real or imagined, being around every corner. What was previously ignored or pushed aside is now the potential trigger to the recent turnaround or a risk yet to be born. DIYers’ overconfidence quickly turns into recognition of their naiveté.

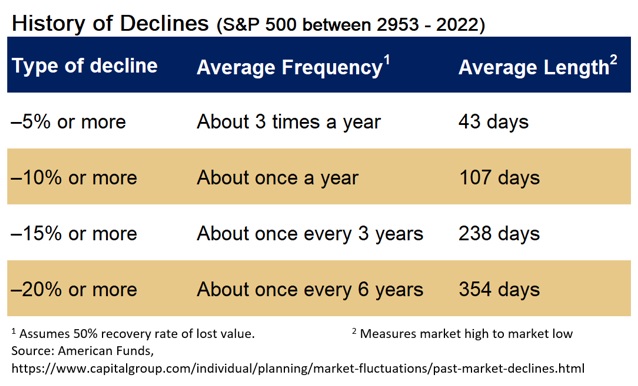

The statistical reality is market pullbacks, albeit momentum exhaustion or more normal run-of-the-mill pullbacks, are more frequent than we like to admit. Even the fastest man in the world, Usain Bolt, needs a break, and race cars need pit stops.

We recognize the last few weeks can be unsettling, but over time, we’ve learned a few things about investing.

- Declines are a normal aspect of investing.

a. The included chart offers a historical perspective. - Keeping perspective will keep you sane.

a. Focus on your long-term objectives, understanding it’s not a straight line to get there. - Don’t try to time the market.

a. Timing is a fool’s errand with significant academic research supporting such. - Emotions can cloud your judgment.

a. Give us a call if your anxiety has notched up a level.

Though the recent pullback hasn’t yet breached the 5% mark, it has caught people by surprise, likely due to the momentum conditioning previously mentioned. Investment fluctuations never replicate history, but there is a statistical rhythm that investors can dance to.

1Captial Research and Management

The S&P 500 Index is the Standard & Poor’s Composite Index of 500 stocks and a widely recognized, unmanaged index of common stock prices. You cannot invest directly in an index. Past performance is no guarantee of future results.

CRN-6558557-041724

Recent Comments