Jobs, Jobs, Jobs. That seems to be the go-to answer when asked, “what’s keeping this economy afloat?” Jobs have been stronger than many anticipated, especially this late in the economic cycle. It seems each month’s preliminary announcement surpasses expectations. There in lines the problem.

Economic data series are often released in threes. An initial announcement followed by revised numbers, which is followed by a final print. The reason is straightforward, underlying data is lagged. Some data series can change quite a bit through the revisions, while others tend to consistently approximate the initial publication. In either case, most investors, professional and individuals alike, often ignore revisions citing “old news.” Monitoring these revisions, no matter how unimportant, can reveal underlying weaknesses or opportunities. A close look at the jobs market may present a more realistic picture of employment and the economy at large.

Throughout 2023, the Bureau of Labor Statistics’ monthly initial employment announcements, consistently surprised Wall Street expectations as well as the Federal Reserve (Fed). The initial reports communicated more workers finding jobs beyond expectations. From an economic standpoint, more workers should be a good thing. But more workers, means more spending dollars in peoples’ pockets, which concerns the Fed due to inflationary pressure. Recall, the Fed is in the mode to squash inflation. (Ever wonder why markets tend to decline in 2023 after employment reports? That’s because a strong labor market would give the Fed reason to hikes rates, hurting financial markets.)

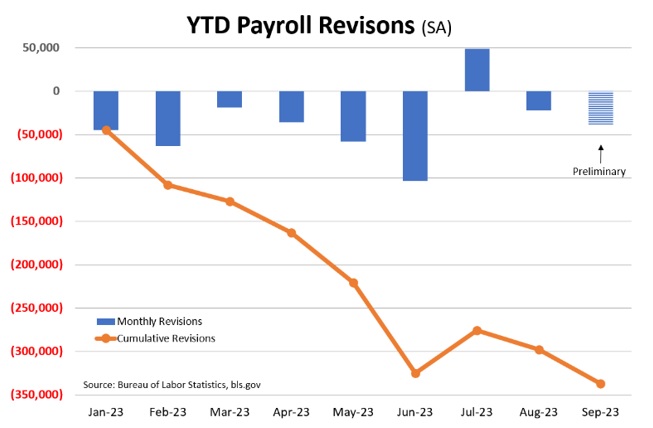

Buried in the monthly reports are previous month’s revisions, which are often ignored. Those revisions can speak volumes. Downward revisions mean the initial release was too high and vice versa. Per above, financial markets and the Fed often hastily reacted to the initial release, not revisions. Markets may ultimately recognize the revisions, but in a more slow and methodical fashion after the initial unsubstantiated reaction.

So, what’s been happening with jobs reports in 2023? In short, far few people are employed than initially communicated. Eight of the last nine months have seen downward revisions. Since the beginning of 2023, initial employment announcements over estimated new jobs by about 350,0001! That’s a big number. Parlance of today’s youth might say, “my bad.” Yet, the Fed is devising interest rate policy based on the initial numbers. Thats a big, “my bad.” Though, meaningful gains against inflation have been made over the past 12 months with further progress needed, significant cumulative downward jobs revisions could be contributing to a more recent dovish Fed, suggesting they may have hastily reacted.

Likewise, financial markets reacted to the initial numbers relative to their impact on the Fed’s decisions. It should be of no wonder why financial markets have rallied recently as the Fed has communicated the likelihood of future rate hike cessation. This allows financial markets to focus on other fundamentals without the Fed’s heavy handiness.

1Bureau of Labor Statistics, blg.gov

CRN-6099600-111523

Recent Comments