Recent headlines suggest the formidable 60/40 portfolio is dead. The “60/40 portfolio is dead” theme is not new with a rash of headlines in 2020, 2018 and even as far back as 2009, repeating like a broken record. Each iteration comes with a well-thought-out rationale. So, let’s examine the 60/40 portfolio.

Recent headlines suggest the formidable 60/40 portfolio is dead. The “60/40 portfolio is dead” theme is not new with a rash of headlines in 2020, 2018 and even as far back as 2009, repeating like a broken record. Each iteration comes with a well-thought-out rationale. So, let’s examine the 60/40 portfolio.

First, what is the 60/40 portfolio? In short, it means a 60% allocation to equities and a 40% allocation to bonds. 60/40 has become popular with institutions and retirement portfolios as many studies have shown the 60/40 portfolio has a very good risk/return characteristic over time. Much of the 60/40 research was performed during a time when bond yields were falling. Bond yields and prices are inversely related; hence appreciating bond prices added to a bond market tailwind.

The 60/40 has been called into question as bond yields have decreased to the point that further decreases are unlikely. Yes, bond yields have been low for 13 years (hence, 60/40 headlines in 2009) with yields moving lower. The economic backdrop was quite different from today. Globalization, vexingly low inflation, eCommerce and other global structural circumstances supported low yields. Today, although the economy is growing, the economic backdrop is dealing with de-globalization (or at least regionalization), paying back massive COVID monetary and fiscal support, inflationary effects and even heightened geopolitical tensions. Point being the falling yields are very likely behind us with rising yields now the likely future path.

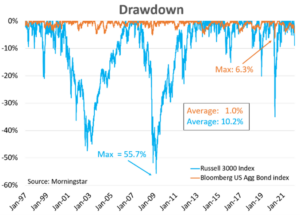

Why include bonds in a portfolio at all? Well, the answer lies in the stability, reliable income generation and lower drawdowns (declines from peak-to-trough). Bonds exhibit more favorable drawdown statistics than stocks, therefore portfolios with meaningful bond exposure mitigate the stock market rollercoaster. As noted in a previous newsletter, bonds usually produce positive returns during periods of rising rates.

Bond managers have a number of strategies they can deploy to take advantage of a forecasted rate environment. A bond fund’s structure can moderate between a bullet, barbell or laddered approach offering flexibility as the credit environment changes. Other strategies include rolling-down-the-curve, shifting among bond types (i.e., government, corporate or mortgage-backed bonds), shifting among credit qualities and/or opportunistic transactions. Hence, bond management is not necessarily stoic.

Bonds should be a staple in one’s portfolio, reducing sensitivity to interest rates with alternative income generating assets may be a worthwhile consideration. Fortunately, today’s financial offerings have income generating assets with reduced interest rate sensitivity. For example, non-traded REITs, interval funds and structured annuities/products generate income from rents/leases, private credit, or derivative payoffs, are just a few alternative fixed income offerings. Investors should recognize these vehicles come with different risks and we have taken the necessary adjustments for this rising rate environment within our portfolios.

Bonds have fixed principal and yield if held to maturity and a default does not occur. Prices of fixed income securities may fluctuate due to inflation, credit, and interest rate changes. Investors may lose money if bonds are sold before maturity or a default occurs. The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp. Neither the information presented, nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Forward looking statements may be subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. CRN-4332501-021622

Recent Comments