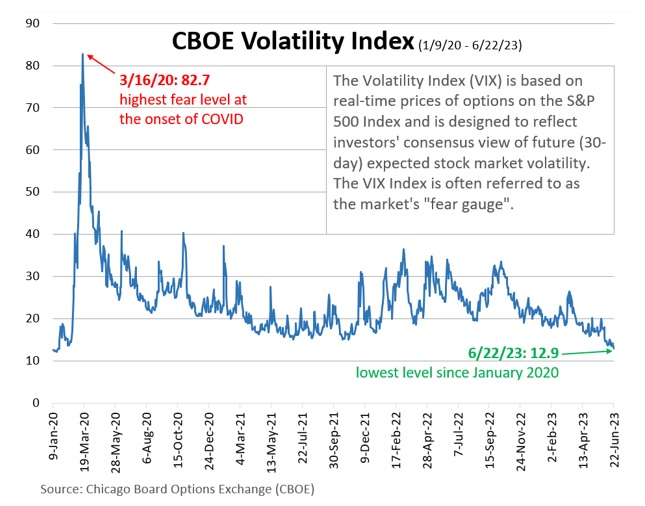

Are you scared yet? If you’re like most investors, the answer is likely, “no.” The Chicago Board Options Exchange’s (CBOE) Volatility Index (a.k.a. VIX) has finally returned to pre-pandemic levels.

The VIX is a nebulous measure. At the end of the day, it measures the stock market’s volatility. Since volatility is a measure of risk, the VIX is often referred to as a “fear gauge.”

There’s good reason for investors to feel more confident. COVID has mostly passed. The Federal Reserve has hinted at the cessation of the fastest rate increase cycle in decades. Inflation is on a downward trajectory. The Debt Ceiling conclusion has abated a U.S. default. Labor markets have been surprised by the upside. Even many economists have reduced their recession probabilities. Though not out of the woods, investors are feeling considerably better.

.

So, what are some of the tender points that can disrupt investors’ composure? First, domestic and global recessions are not out of the question. Economic activity continues to deteriorate. Second, lower company earnings are still a likely event. (Recall, stock prices are ultimately a function of the profits, no profits… no stock appreciation.) Third, the labor market has bifurcated, with hiring being concentrated in lower-end jobs while white-collar layoff announcements accelerate. Fourth, core inflation remains sticky. Fifth, stock valuations (especially growth stocks) could be considered elevated. Sixth, geopolitical tensions remain high.

Investing requires vigilant risk awareness. Think of a long-tailed cat in a room full of rocking chairs… become too complacent, and you’ll undoubtedly encounter a painful consequence. Complacency leads to letting your guard down and opens one up to the unforeseen left hook. A valuable lesson to all investors is to never become complacent. Another way to think about investing is to get comfortable with being uncomfortable. We’re not attempting to downplay recent optimism. We’re suggesting there are many sides to the investing equation.

All risks can’t be avoided. Even stuffing cash under the mattress exposes one to purchasing power risk (i.e., inflation’s impact on your purchasing dollar). Acceptable exposure to acceptable hazards is the primary defense to aggregated risks. With the approach of our country’s birth, please enjoy next week’s July 4th!

CRN-5776361-062723

Recent Comments