Ever wonder how topics are recognized as a National Day? Is it an act of Congress, or a declaration form the President? It may surprise you to find out subjects hoisted to such prominence simply requires an application to the National Day Archives.

National Days have been used to bring awareness of important events, such as January 1st is the “January 1st 1863, Emancipation Proclamation Day” to commemorate President Abraham Lincoln’s executive order #95 that lead to the eventual liberation of American Americans1. National Days have also been used remind us of civil society with November 21st World Hello Day1; or promote commercial ventures such as May 1st National Lemonade Day1.

It just so happens that January 19th was National Investment Risk Management Day1. National Investment Risk Management Day is a day when investors are reminded of the risk within their portfolios and various risk mitigation techniques.

Investors are conditioned to measure the performance in terms of returns. “Did I make money?” The risk side of the coin is rarely visited which is “how much risk am I taking to earn those returns.” Risk may not be apparent until it’s too late. Not too long ago, Tesla (symbol TSLA) was trading over $400/share. Yet, many investors have losses as Tesla is trading around $200/share. Remember when AMC Entertainment (a.k.a. AMC Theaters, symbol AMC) shot up to over $500/share. The stock is now trading around $4.50/share.

Portfolios are developed in a way to mitigate these types of risks. The first strategy is via investment diversification. Investment diversification is the science of not putting too many eggs in one basket. The basket being a stock, an asset class, or a theme (such as, the current AI push many are talking about). This will mitigate the vast majority of a portfolio risk.

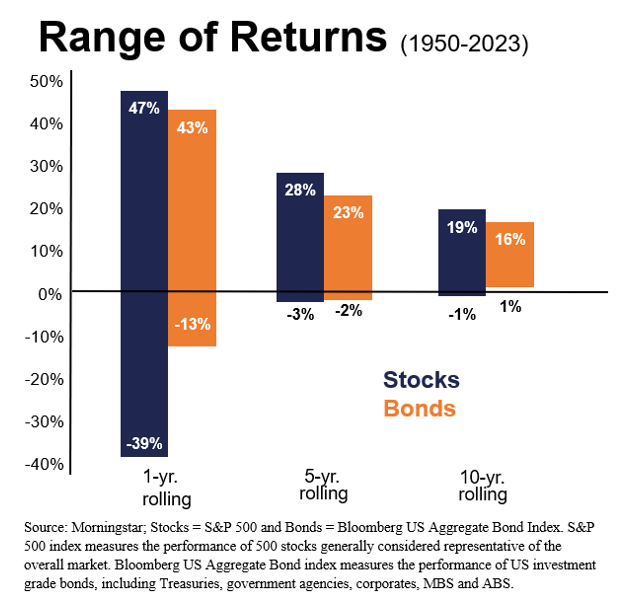

Secondarily, portfolios should be developed with an eye towards time diversification. Lesser-known time diversification is investing in certain assets/classes that match the risk characteristic of the investment. For example, an investor wanting to buy a car in six months should put their money in a safe place such savings or money market. But an investor that doesn’t need the money for 10+ years, should have a meaningful equity exposure as the downside has historically been very limited over any 10-year period.

Most investors have a combination of financial goals ranging from near-term to long-term. Investment portfolios need to address those objectives as well as be cognizant of the risks being taken. Portfolio management is often thought of as a return generating venture, but portfolio managers more often think of it as a risk management endeavor with returns being a byproduct.

1National Day Archives

Diversification may help reduce, but cannot eliminate, risk of investment losses.

CRN-6286942-012324

Recent Comments