February exhibited something we haven’t experienced in a while: market volatility. In recent months, investors have been conditioned with below normal volatility accompanied by advancing equity and fixed income markets. Such dynamics can lure investors into a false sense of security. February’s performance was akin to grade-school teacher’s reminder to sit up straight, pay attention, and not to slouch.

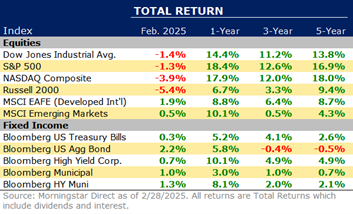

Larger company stocks, as represented by the S&P 500 Index, clocked a new high in mid-February before a slide in the latter half of the month. The technology-heavy NASDAQ Index approached December’s highs before succumbing to a similar slide. Much of the talk in recent years has centered around The Magnificent 7, a handful of stocks (Meta, Apple, Amazon, Microsoft, NVIDIA, Alphabet, and Tesla) driving recent market advancements, which has shown even they are not impervious to declines. The Roundhill Magnificent Seven ETF, an ETF designed to emulate the Mag-7 stocks, was down about 8.5%.

Investors undertook a flight to quality as bond yields fell, pushing bond prices higher. Specifically, higher investment grade bonds enjoyed the bulk of the fixed income appreciation while lesser quality bonds trailed. This is often the case when investors become anxious about economic prospects, interest rate policy or other uncertainties.

Moderating economic data was just enough for investors to raise concerns over previous soft-landing calls. In the latter weeks of February, Consumer Confidence and Consumer Sentiment measures recorded unexpected pullbacks. Recall, about 2/3rds of the economy is driven by U.S. Consumers making consumer angst a notable data point. Sticky inflation data gave the Federal Reserve reason to suggest a more hawkish stance than previously communicated adding to the market’s whipsaw effect.

International stocks, both developed markets and emerging markets, were benefactors of the U.S. stock market’s troubles. Some of this was associated with the falling U.S. dollar as well as economic data that bested gloomy European outlooks. European forecasts progressed from gloomy to ho-hum, a positive direction, nonetheless.

February was President Trump’s first full month of his second term. The first 5-6 weeks were witness to significant turmoil, something financial markets tend to eschew. At times, the market applauded policy changes, while the market disapproved at other times. As difficult as it is, we should be careful not to let our political views influence our longer-term objectives. The political pendulum is in a constant state of motion.

Overall, February 2025 was marked by economic moderation and mixed market performances across major regions. The interplay between early signs of consumer trepidation, sticky inflation, labor market dynamics, and geopolitical tensions will likely continue to shape economic and financial market trends in the coming months, something that we will continue to monitor.

Recent Comments