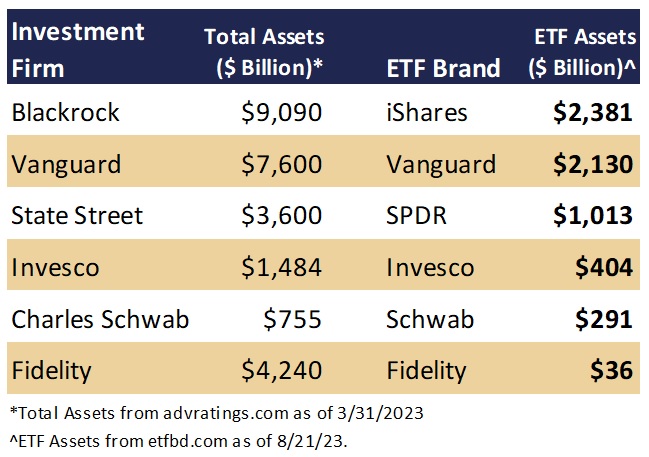

Recent podcasts and articles have focused on company ownership and proxy voting insinuating a conspiratorial connection. It should come as no surprise that large investment firms continually show up as some of the largest company shareholders. For example, Microsoft’s top shareholders are Vanguard, Blackrock, and State Street1. Could it be financial chieftains have cooked up a plot to rule the world or could it simply be the largest investment firms, especially index fund managers, have naturally bubbled to the top? Likely the latter. As index fund investing has gained popularity, so have the investment firms deploying such strategies.

Proxy voting traditionally took the role of optimizing stock value. Vote “for” to advance a stock’s value and “against” if a proposal detracts from value. Over the past decade, community involvement has gained interest. Due to firms’ fiduciary duties and to aid transparency, the Securities Exchange Commission (SEC) requires investment firms to file Form N-PX, a disclosure of the firm’s proxy voting.

More recently, the SEC has undertaken proxy voting surveys. In other words, the SEC is requiring investment firms to enact a process for investors to express their opinions on company proxies and proposals. Most firms have rolled out proxy voting opinion to their institutional investors and are working on rolling out a similar process to the hordes of individual investors. It’s more complicated than one might think.

Investors can review investment firms’ voting history, though the details are not easily found. Shareholder votes are buried in their websites. Below are links of the three largest ETF providers.

Blackrock: http://vds.issproxy.com/SearchPage.php?CustomerID=10228

Vanguard: https://vds.issgovernance.com/vds/#/MjAxMA==/

State Street: https://vds.issgovernance.com/vds/#/MTA1/

Tread carefully as you peruse shareholder voting. Corporate proxies are not as juicy as the National Enquirer. Don’t expect details of an alien abduction or a celebrity’s transgressions. Often, corporate proposals include board seat selections, raising capital, or approving an Employee Stock Purchase Plan. Be careful what you wish for, you might get it.

1https://finance.yahoo.com/quote/MSFT/holders?p=MSFT&nn=1

CRN-5901046-082323

Recent Comments