Stock market corrections can be scary, but they are a normal part of investing. It’s hard to believe, but they are a sign of a healthy market. Market swoons are simply the market’s way of blowing off steam. Market corrections often come after a period of market advances with low volatility, conditioning investors to think corrections are a thing of the past. So, when they occur, it’s often an anxiety-driven surprise.

Anticipating a correction can be stressful.

First, resist the urge to “time the market.” Although it’s possible to make some short-term money by trading the ups and downs of the market, strategies like swing trading rarely work for building long-term wealth. Most people lose by trying to move their money around to participate in the ups and avoid the downs. This is a documented behavior studied by academics around the world. The field of study is called behavioral finance.

Data show that not only do most people lack the discipline to stick to a winning investing playbook in correcting markets, but they also tend to transact at the wrong times, causing even larger losses. Professional financial planners build portfolios based on science vs. behavioral biases. When we build a portfolio, we expect that one out of every four calendar quarters will have a negative return. We control the magnitude of the negative returns by selecting a mix of investments that have either more potential for upside or less potential for high returns and less risk, a process called “diversification.”

The statistical reality is market pullbacks, albeit momentum exhaustion or more normal run-of-the-mill pullbacks, are more frequent than we like to admit. Even the fastest man in the world, Usain Bolt, needs a break, and race cars need pit stops. Resist the urge to trade during corrections. Follow the old Wall Street adage, “Never catch a falling knife.”

We recognize the last few weeks can be unsettling, but over time, we’ve learned a few things about investing.

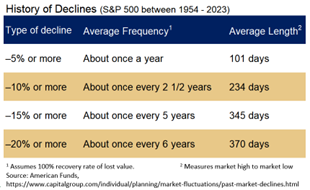

- Declines are a normal aspect of investing.

- The included chart offers a historical perspective.

- Keeping perspective will keep you sane.

- Focus on your long-term objectives, understanding it’s not a straight line to get there.

- Don’t try to time the market.

- Timing is a fool’s errand with significant academic research supporting such.

- Emotions can cloud your judgment.

- Give us a call if your anxiety has notched up a level.

Some stock market indices have breached the 5% mark while others, mostly technology-heavy or high-valuation indices, have logged a +10% correction. Investing is a stressful endeavor due to such declines. We attempt to mitigate these stressful environments through portfolio construction techniques, protection strategies, and diversification policies built into your portfolio without trying to time the market, a proven useless tactic. With that in mind, we’ll get through the latest round of volatility together.

Recent Comments