Economic data continues to surprise to the upside. Many professional investors, strategies and economists are a little dazed by the resilience of the U.S. economy. Could the much anticipated and talked about recession never come to fruition?

There is little wonder why professional prognosticators concluded an imminent recession. By almost every traditional measure, the economy was marching towards recession. Sure, soothsayers began recession calls as early as 2022 with the inception of the Federal Reserve’s (Fed) aggressive rate hike cycle. Afterall, the Fed has along track record of causing recessions and a short one of soft landings.

As the past 21 months transpired, traditional recession markers started falling one by one. These included:

1) An inverted yield curve (the difference between the 10-year Treasury and the 3-month Treasury),

2) An uptick of Unemployment Rate, beyond the normal month gyrations,

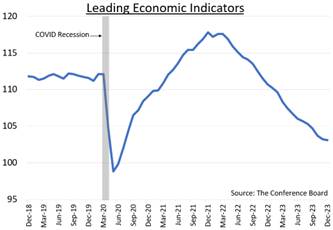

3) Falling Leading Economic Indicators,

4) Rising Unemployment Insurance Claims,

5) Contracting manufacturing measures,

6) Accelerating layoff announcements,

7) Falling housing permits and starts.

Yet, the economy continued to hum along. Thank the good old U.S. consumer. Should the Olympics have a metal standing for consumption, U.S. consumers would be the undisputed Olympic gold medalist every year. In fact, a recent visit to the Federal Reserve’s Baltimore branch to hear from Fed officials, stated their biggest surprise was U.S. consumer resiliency. The second surprise was the similarly resilient job market. (Opinions were that of the speaker and not of the Federal Reserve.) The combination of work (putting money in pockets) and significant credit card debt increase, fully explains consumer resiliency.

The most recent round of data has reversed some of the negative trends with some signals flashing red to just flashing caution. During the same Fed visit mentioned above, the presenter mentioned signs of pent-up housing demand. Could Fed rate cuts spawn a housing binge? Further, could a new round of housing sales drive downstream industries?

Although the outlook for the economy has improved slightly, it’s a good idea to remain grounded. Also, recall the stock market is not the economy. Companies deal with a mountain of inputs to arrive at their earnings; economic performance is just one.

CRN-6398563-021324

Recent Comments