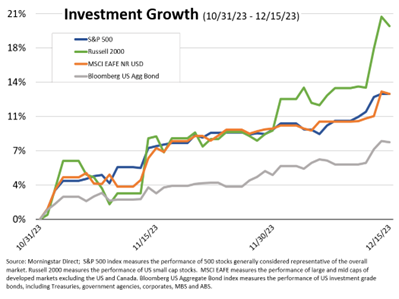

A few weeks ago, we speculated whether the early Santa Claus rally would continue. So far, the answer seems to be Yes! The recent jaunt added to year-to-date performance for most asset classes and sectors, lifting them into positive territory.

Patient investors can rejoice with their decisions not to take aggressive alternative action. Afterall, the third quarter ended with a thud as the Federal Reserve’s (Fed) surprise July hike was followed by less than favorable guidance. Even bond investors were worried as YTD bond performance turned slightly negative at the third quarter’s conclusion.

What a difference a couple months make. The Fed’s data driven approach rarely recognizes that data is naturally… historical. Economic data is by its very nature a report card of what happened as opposed to a prognostication of what’s to come. It is akin to driving by looking through the rearview mirror. Financial markets dislike the Fed’s meddling. The Fed’s admitted rate hike cycle culmination is all that was needed to springboard stocks and bonds northward. November’s returns clocked one of the best monthly returns ever for both stocks and bonds. The question remained, did the Santa Claus rally arrive early or will it continue?

The final 2023 Fed meeting, on December 13th, was accompanied with an acknowledgement of likely rate cuts in 2024. Reading between the lines, the Fed recognized prone recessionary pressure requiring economic reacceleration, hence rate cuts. As much as the financial markets hate rate hikes, the opposite is true for rate cuts. The Fed’s rate cut declaration set the stage for holiday cheer, possibly too much cheer.

Almost every traditional economic signal is flashing red. Yet, people keep buying things and experiences putting adding to credit card balances. This can’t continue forever. Having said that, it’s important to recognize that the economy is not the stock market. The last 6-7 weeks has been a reminder of such. The last 6-7 weeks is also a reminder that investing is a long game filled with numerous short games. Golf, similar to investing, is a game of 18 holes (not 2 or 3) filled with many swings, puts, and even mulligans.

It’s easy to get caught up in the near-term doldrums or euphoria, but not getting caught up in either is the best investing medicine. We’ll take the Santa Claus rally as it comes understanding there will come a time when a little give back occurs. Happy Holidays as we approach the conclusion of 2023.

CRN-6173183-122023

Recent Comments