The recent equity market ups and downs appeal to our innate desire to avoid risk. In investing terms, this means selling when volatility appears. Selling after a decline feels safe. “Ahh, I’ve avoided the drop.” The reality is you’ve realized the drop and removed yourself from the upswing and potential reward.

Imagine if you met with a financial advisor who hovered over a crystal ball and told you he could see the future. You’d probably walk out immediately or at least check for the hidden camera. But if you rely on market timing for portfolio decisions, you might as well be visiting a fortune teller. No one can predict the future.

Market timing, to some degree, involves doing just that. It’s an investment strategy that attempts to identify the best times to be in the market and when to get out in an effort to reap the greatest rewards. However, successful market timing requires you to anticipate market gyrations, not simply react to current market changes. Financial markets incorporate a myriad number of effects, some fundamental, some behavioral, and even some whimsical. Determining which is most influencing the market at any given moment is a near impossibility. Understanding the market statistics, larger trends, and bigger-picture effects will keep you from falling into the market timing trap.

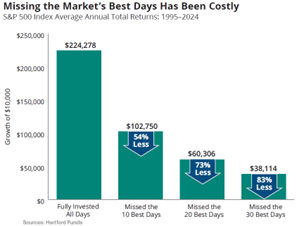

The real risk of market timing is missing out on the market’s best-performing cycles. For example, an investor, believing that the market will go down, takes his money out of stocks. While his money is out of stocks, the market may have its best-performing months. By incorrectly trying to time the market, this unfortunate investor missed out on those profitable months. Missing only the 5 best months over a 30-year period could have a significant impact on your overall returns; missing more than that could have an even greater negative effect. Big up and down movements tend to be clustered. No better example than the last few weeks.

A wiser strategy is to develop an asset allocation that recognizes financial markets experience volatility (especially equity markets), addresses your risk tolerance, and incorporates various investment horizons. In the end, it is best to stay invested specifically during periods of volatility. By doing so, you’ll be able to participate in any top-performing days, and you’ll have the power of compounding working for you. This means that the money you have invested actually works to make more money for you.

The academic research is clear on this matter. The largest contributor to portfolio performance is the asset allocation. Timing, or when actual buys and sells are placed, plays a de minimis role… unless, of course, you decide to sell after a decline.

While market timing, on the surface, may appear to be a quick way to reap great rewards, it is a strategy best left to the waste bin. Time-in-the-market, not timing-the-market is a better approach. That means staying invested for the long haul… and throwing away that crystal ball!

Recent Comments