COVID did it again! Just when it appeared the world was moving past COVID and its progeny, a new variant was announced, but we’ve seen this movie before. The initial COVID shook the world with variants being less demonstrative. Omicron is the 15th letter in the Greek alphabet, meaning there have been many other COVID variants with Delta being the most notable.

COVID did it again! Just when it appeared the world was moving past COVID and its progeny, a new variant was announced, but we’ve seen this movie before. The initial COVID shook the world with variants being less demonstrative. Omicron is the 15th letter in the Greek alphabet, meaning there have been many other COVID variants with Delta being the most notable.

The news from South Africa came while the U.S. was celebrating Thanksgiving and offered minimal reaction time last Friday. Although little was known about the latest variant, Omicron, uncertainty ensued causing a market decline. Remember, uncertainty, any uncertainty, is the market’s kryptonite.

The fear that accompanied Omicron may have been undeserved. Omicron seems to have originated in South Africa where vaccination rates are low1. The strain was caught via normal PCR tests and not a special diagnostic test, meaning detection was easy. Omicron seems to be more transmissible due to the 29 protein mutations, yet Omicron symptoms seem to be rather mild. Current vaccine effectiveness is being explored with a recent GlaxoSmithKline post stating high Omicron effectiveness with their COVID therapy2. At the same time, some of the leading pharmaceutical companies have mentioned the new mRNA vaccine development could have an Omicron specific vaccine available in the coming months. Point being the recent volatility may have been a reaction without sufficient information.

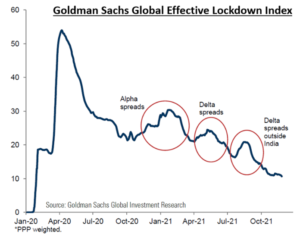

As we progress through this era, the world populous is becoming more immune to variant announcements. Many may have forgotten the first variant, Alpha, which caused consternation, but had little impact. The most memorable variant was Delta which turned out to be more ho-hum than Ka-Pow. Based on the Goldman Sachs Effective Lockdown Index, the world is learning to live with COVID, and its offspring as opposed hoping for virus eradication. Even though last Friday experienced a dramatic decline, the market decline upon the Delta announcement was more severe.

In the end, business and economic fundamentals matter. So where are the fundamentals?

1) Leading Economic Indicators are strong and advancing3,

2) Consumer spending (about 70% of the U.S. economy) is high4, and

3) Labor markets are tight with plenty of job openings4.

This is not to say the U.S. and the world economies are free from challenges, such as plaguing supply chain disruptions and inflation concerns. But the preponderance of the evidence suggests positive progress.

1Ourworldinda.org 2US.GSK.com 3The Conference Board 4St. Louis Federal Reserve

CRN-3946148-120621

Recent Comments