China got old before they got rich! Over the past 15-20 years, there were copious calls for China’s rocket trajectory to eclipse the U.S. as the world’s largest economy. For those old enough to remember, these forecasts echoed sentiments similar to those of Japan in the 1980s. It’s been clear for the past 3-4 years that China’s prophesized destiny is not likely to be realized.

The main difference between today’s China and 1980s Japan was the timing of their

population challenges. Both became the second-largest global economy before their demographic problems were confronted. Using inflation-adjusted dollars, Japan’s GDP per capita reached over $44k1 before Japan’s growth started to wane. China, on the other hand, has yet to breach $13k GDP per capita1 as its population commenced contraction. In other words, Japan became rich before they got old, whereas China grew old before they got rich. (You may recall that India overtook China as the world’s largest population in 2023.2)

China’s problems were sewn in 1979 with the commencement of their one-child policy. Early on, China recognized that population addition would place an extreme burden on resources. To combat future liabilities, China restricted households to a single child, which lasted until 2016. That’s 37 years or two generations of population braking. Fast forward to 2020, China’s population was quickly aging without the requisite youngsters to support older generations nor the economic heft to draw upon. Though Japanese current family-aged citizens eschew family creation, Japan’s economy created tremendous economic goodwill via enduring global brands, economic savings, and laudable government interactions.

China’s attempt to become the world’s global manufacturer worked for a while, especially for inexpensive items. However, their actions during a global pandemic (hoarding PPE, undermining people in need, obfuscating their involvement) highlighted the government’s self-centered objectives and lack of compassion. Repercussions caused foreign firms to re-examine China’s mafia-style competitive intel disclosure, which China exploited to create carbon copies. Results include foreign firms abandoning Chinese operations.

The world began examining China’s “altruistic” Belt and Roads Initiative. The Belt and Road Initiative was Chinese-led massive infrastructure projects in struggling countries as “pay-it-forward” prosperity assistance. Upon closer post-COVID examination, the financial terms were purposely harsh and intended for China to foreclose on projects, taking possession of the land, resources, airports, highways, etc.

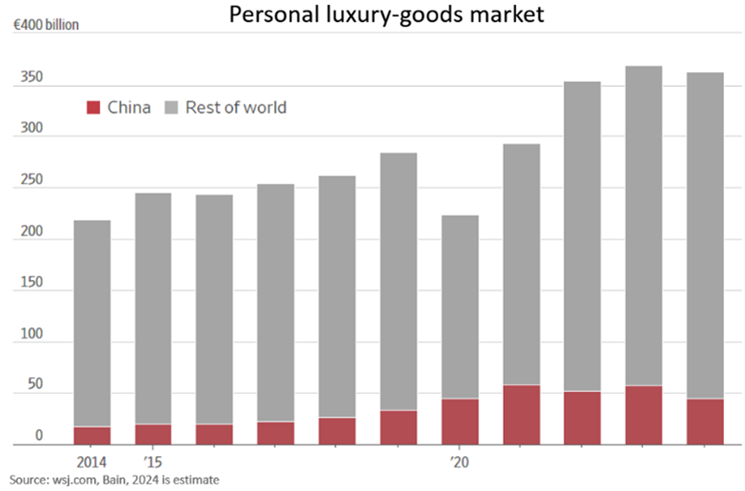

As skepticism of China has grown, so has foreign insulation from China, which has compounded China’s demographic downturn. China’s desired shift from a manufacturing economy to a services economy may not transpire. In fact, Chinese consumer luxury goods consumption has waned in recent years, countering global trends, which may serve as China’s coalmine canary. At this point, we remained committed to mitigating Chinese equity exposure due to demographics, foreign disinvestment, troubling financial and real estate markets, and questionable governance.

Recent Comments