The vacillating VIX vexed investors during April’s volley. April’s rainy month was accompanied by stock market jitters. A dreary April can be expected at this part of the annual cycle, but the VIX can be a wild card.

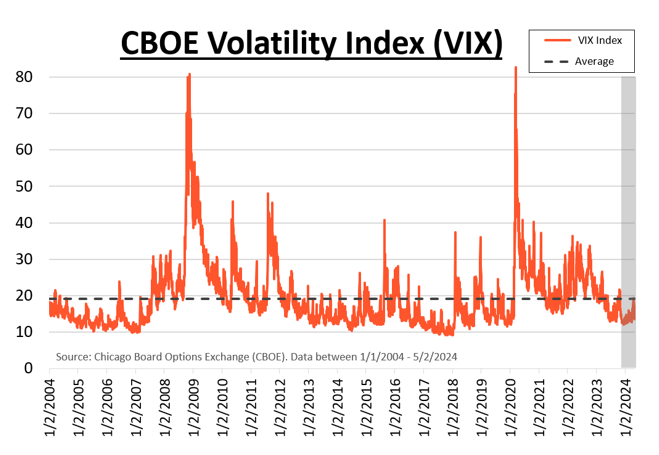

The Chicago Board Options Exchange’s (CBOE) Volatility Index (a.k.a. VIX) is a nebulous measure. At the end of the day, it measures the stock market’s volatility, or the market’s oscillation. The VIX is often referred to as the “fear gauge.” Confident periods are typically accompanied by low VIX levels, while high points convey anxious investors.

April’s higher VIX levels caught many by surprise. This is partly due to recency bias. Recency bias is a cognitive favoritism for recent experience over historical norms. The five-month period leading up to April was marked with a VIX below the historic norm (see the shaded area in the chart). That puts us back at the end of October with the holidays, cold wintery days, and the Super Bowl ahead of us. That was a long time ago… in terms of cognitive perception. No wonder April’s heightened volatility caused anxiety.

Let us take a step back for a broader perspective. Let us go back 20 years. (We could go back further but the historical picture has minimal change.) From this vantage point, the recent uptick in volatility simply returned to the historical average. In other words, the recent volatility is routine and well within the norm.

What caused slightly higher volatility? In short, the market’s reaction to mixed economic data. Data released throughout April produced a mixed picture with resilient consumer spending and signals that inflation is abating fast enough. The Fed’s call for “higher [rates] for longer” disappointed investors, similar to a birthday boy not being allowed to open his presents. Excited anticipation was replaced with distraught veracity.

Oscillations come in daily, weekly, monthly and annual movements. Naturally, volatility levels spend time above and below the long-term average. Afterall, an average is just that. At extremes, volatility can be considered contra-indicators. Very high volatility will eventually calm. Calm volatility will eventually lead to unrest. Internalizing the ebb and flow of volatility and how it relates to the long-term average can help mitigate one’s investing anxiety.

Gloomy can be used to describe April’s financial markets as well as April’s weather. At least with the weather, there is an old saying, April showers bring May flowers. We hope you enjoy May’s more cheery days.

CRN-6605603-050724

Recent Comments