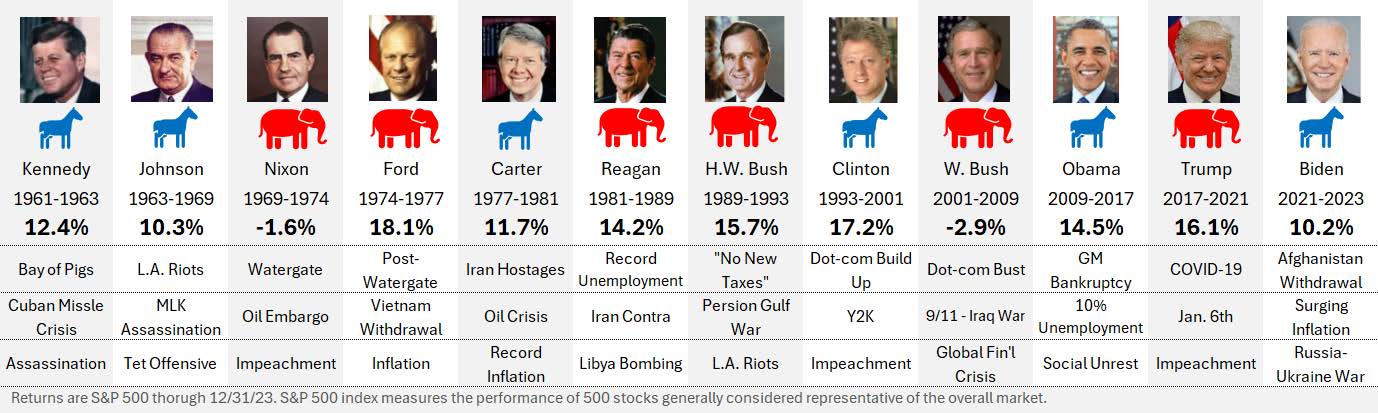

Despite common perceptions, empirical evidence shows that the stock market’s performance does not strongly correlate with presidential administrations or the president’s party. This lack of clear correlation underscores the complexity of market dynamics and the multitude of factors that influence stock market returns.

One key reason for this disconnect is the multifaceted nature of the stock market, which is influenced by a broad array of variables beyond presidential policies. Global economic conditions, technological advancements, corporate earnings, and geopolitical events all play critical roles in shaping market performance. For instance, international trade policies, global economic trends, and technological innovations can have a profound impact on markets, often overshadowing the effects of any single administration’s policies.

Furthermore, the stock market tends to respond to expectations and future prospects rather than just current policies. Investors make decisions based on anticipated economic conditions and corporate performance rather than the immediate effects of a president’s actions. For example, a president’s policy proposals might influence market sentiment, but actual market movements are often driven by broader economic trends and investor expectations.

Historical data also supports the argument that presidential administrations do not consistently drive market returns. Studies examining stock market performance across different presidential terms have found no consistent pattern of higher or lower returns linked to the party in power. Market performance varies widely from one administration to another, suggesting that other factors, such as economic cycles, interest rates, and external shocks, or even delayed effects of previous administrations’ policies, play a more significant role.

Presidents often inherit economic conditions from their predecessors, and their ability to influence the market can be constrained by these pre-existing circumstances. For example, a president who takes office during a period of economic expansion or recession may experience market outcomes that reflect these inherited conditions rather than their own policy choices.

The lack of strong correlation between U.S. Presidents and stock market returns highlights the complexity of financial markets. While presidential policies and leadership style do play a role, they are part of a broader set of factors influencing market performance. The stock market’s response to presidential actions is often overshadowed by global economic trends, investor expectations, and other exogenous variables. This nuanced understanding underscores the importance of considering the broader economic context when evaluating the impact of presidential leadership on market outcomes.

CRN-7000873-091024

Recent Comments