In recognition of Earth Day this week, it’s important to acknowledge an investment process that is gaining momentum and becoming more utilized by investors. I’m speaking of the growing interest in Environmental, Social, and Governance (ESG) investing.

Investing has traditionally been associated with income generation or wealth accumulation… putting your money to work so you don’t have to. Historically, these endeavors focused solely on financial aspects. Will I get my money back? How will an investment perform? How long until the investment pays for itself? Will the company be profitable? In recent years, an investment discipline that considers non-financial qualities (such as societal impact) has grown in popularity. The

movement has been around for decades and attracted close to $52 Trillion1, according to the 2024 biennial report from The U.S. Sustainable Investment Forum. Climate footprint remains the dominant theme, with a strong emphasis on clean energy transitions, carbon reduction, and nature restoration.

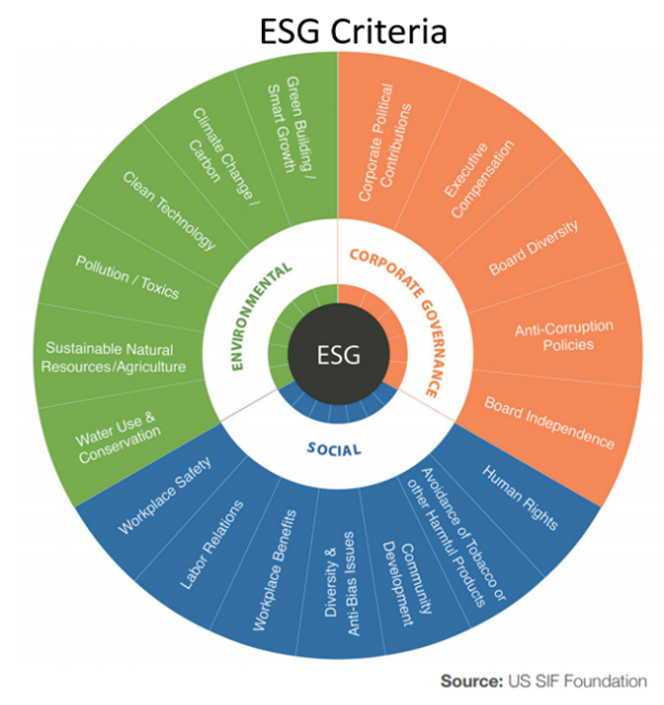

The idea behind the ESG discipline is to augment investment performance, not subjugate it. From an investment manager’s point of view, ESG criteria may be able to help identify investments with a competitive advantage poised for enhanced long-term performance. For the individual investor, ESG is a way to align a set of personal values with one’s investment dollars. ESG considers environmental impact, social effects, and corporate governance. Each of these three main segments can be further subdivided. Social analysis, as opposed to financial analysis, can be conducted on these individual slices to determine a company’s ultimate ESG score. Social analysis offers a different analytical lens to complement traditional financial analysis for increased transparency.

At a high level, ESG is a way to align one’s social interests with one’s financial interests. The origin of ESG began decades ago by focusing on companies that were good stewards of spaceship Earth. ESG has splintered into categories with a specific focus, such as green energy, and even alignment with faith-based criteria. Individual investors have a few implementation options. The first is the popular mutual fund structure, which has grown from a few niche players to some of the biggest active and passive mutual fund providers. More recently, Exchange Traded Funds, or ETFs, have entered the picture. ETFs, historically passive investment vehicles, have migrated to active ESG security selection.

ESG and the various permutations have gone from an investment niche to mainstream. ESG screening is increasingly employed by traditional investment managers looking to grasp an analytical advantage. Should ESG investing intertest you, please don’t hesitate to let us know.

Recent Comments