Entering 2025, investors were feeling optimistic. The S&P 500 had just delivered back-to-back years of returns over 20%. The Federal Reserve had started aggressively easing interest rates, suggesting inflation was under control. Artificial Intelligence (AI) development and deployment pointed to a futuristic dawn was within reach. Stocks advanced on a euphoric high, pushing already elevated valuations higher.

However, market sentiment changes quickly. Over the back half of the quarter, stocks dropped sharply, pushing the S&P 500 down more than 10% from highs before the end of the quarter, officially putting the market into a correction. As of the morning of April 4, stocks are approaching bear market territory (20% drawdown), with the S&P 500 down 16% from the recent peak. This quick downturn brought with it a shift in market dynamics.

President Trump commenced his second term and wasted no time implementing his objectives. The administration’s approach, laid out in the “America First Trade Policy” memorandum signed by President Trump on January 20, 2025, calls for a comprehensive review of U.S. trade relationships and industrial capabilities1. At its core, this plan tackles trade imbalances, the loss of manufacturing jobs, and vulnerabilities like those exposed by COVID-19. It’s a reaction to decades of offshoring and a bet that the U.S. can reclaim its industrial edge. The scope is huge, covering trade deals, tariffs, taxes, and industrial investment.

Geopolitical happenings have introduced a new acronym into our vocabulary, CRINK, which stands for China, Russia, Iran, and North Korea. Over the years, these four nations have quietly pressed for an alternative to a Western-centric world paradigm, mainly economically abut also militarily. Such chants have grown in volume. Actions of these nations’ central banks have begun accumulating non-dollar currency assets, including precious metals. Economic objectives include challenging the U.S. dollar as the world’s reserve currency as well as creating a trading block absent of Western influence. Though this is a slow-moving initiative that could take many years or even decades to transpire, if, at all, such efforts are on our radar.

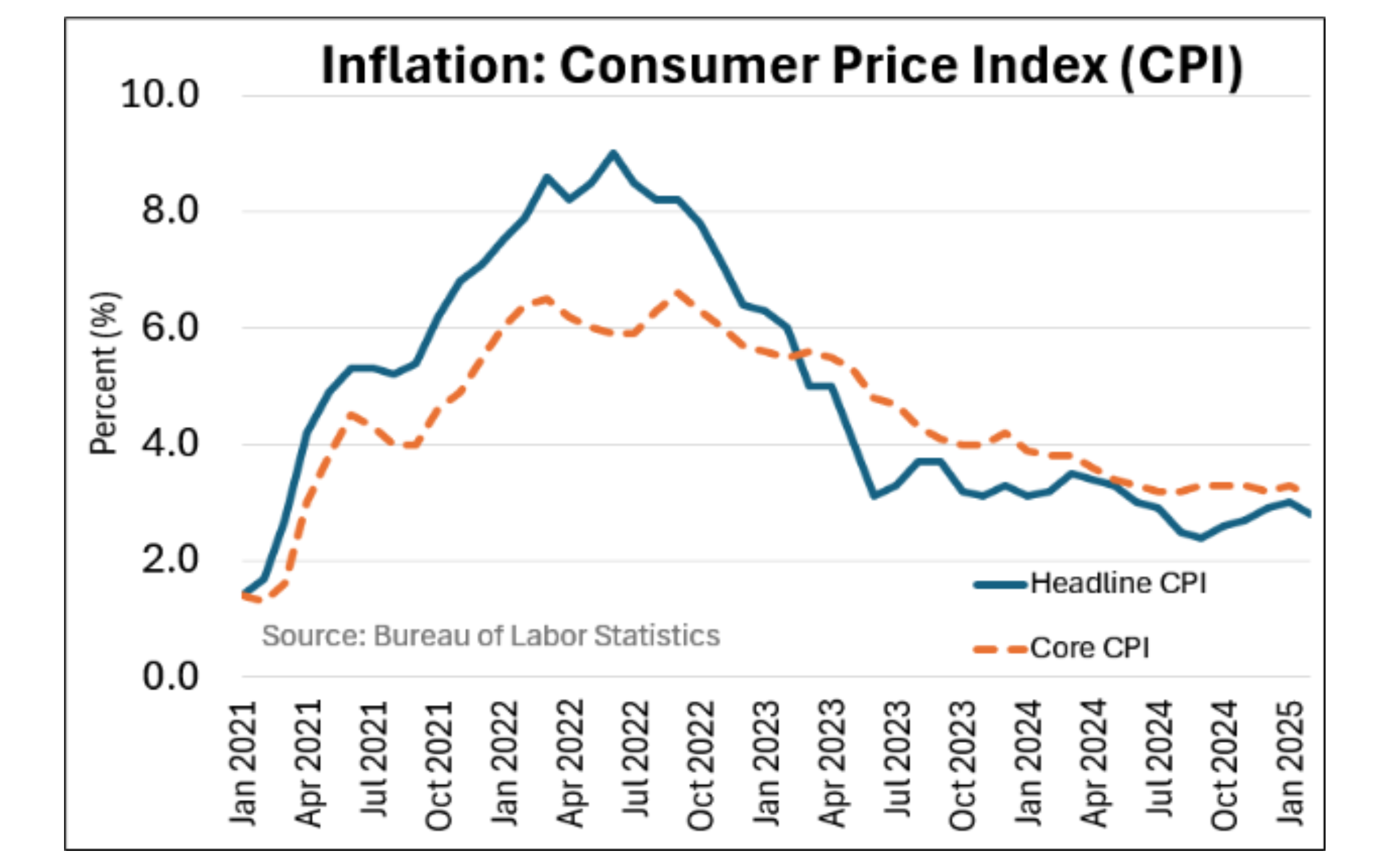

In response to the economic developments in the first quarter of 2025, the Federal Reserve (Fed) tempered its interest rate outlook. The Fed entered 2025, projecting four rate cuts totaling 1.00%, yet revised their outlook to just two cuts, or 0.50%, due to an inflationary uptick and solid economic backdrop. Unrecognized by most, the inflationary uptick was mostly due to energy’s evaporating DEflationary effect. What was a detraction to overall inflation was now neutral, giving the appearance of higher overall inflation. The reality is almost all price components continued their disinflationary progression.

As the quarter marched on, more recent data prompted the Fed to reduce its GDP forecast and adjust its expected unemployment rate. The Fed grew concerned with forward-looking consumer survey data weakness and softening, and yet still solid, labor markets. The Fed emphasized its commitment to achieving maximum employment and price stability, signaling a balanced approach to monetary policy in the face of economic uncertainties.

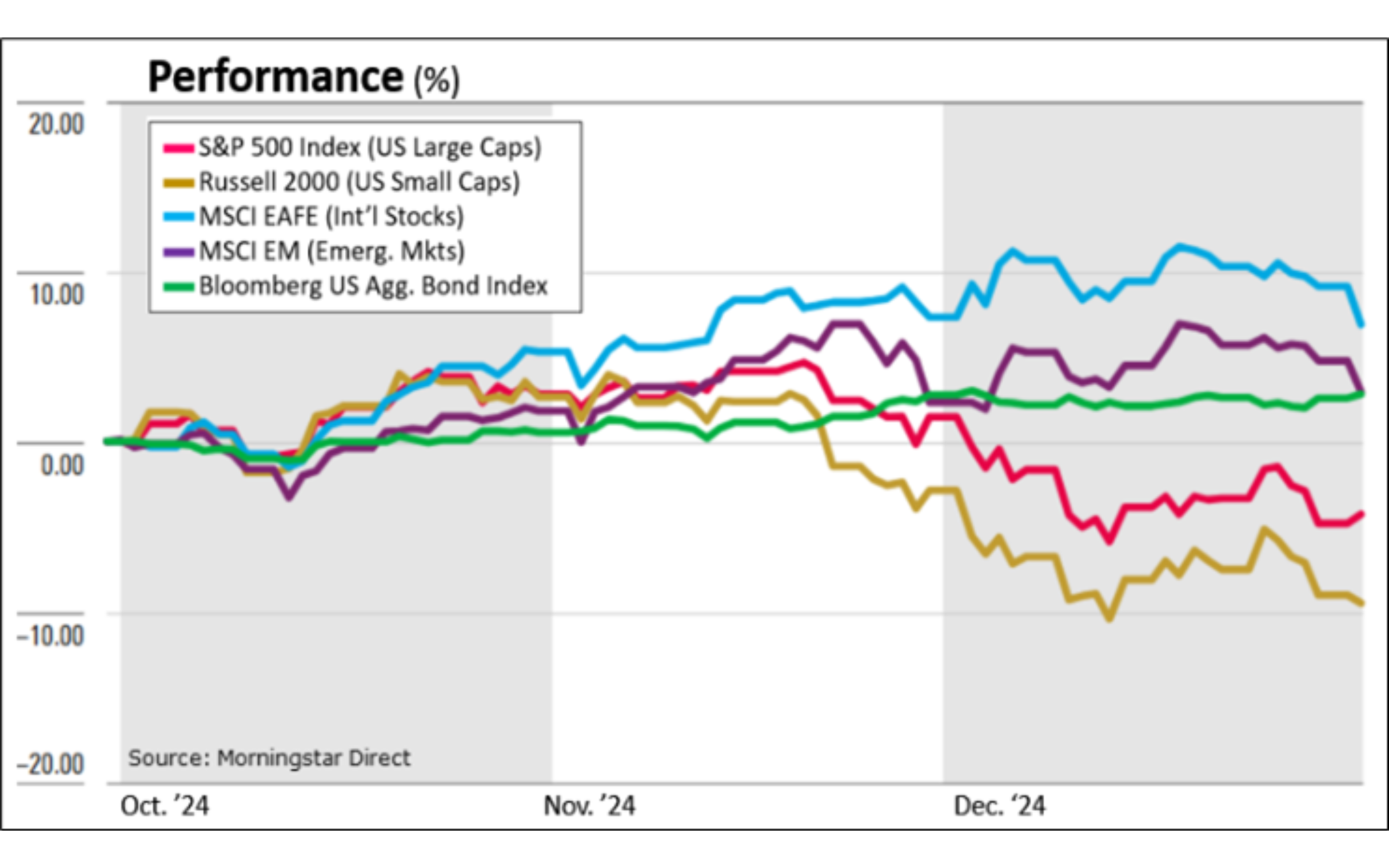

EQUITY MARKETS

Stocks advanced on a euphoric high, pushing already elevated valuations higher. The highest valuations were associated with giant technology stocks and/or AI-focused stocks, a subset being labeled the “Magnificent 7.” Those same high valuations make stocks sensitive to news that does not confirm jubilant expectations. Market sentiment changes quickly. What often leads to an advance also leads to a decline.

Over the back half of the quarter, stocks dropped sharply, pushing the S&P 500 down more than 10% from highs before the end of the quarter, officially putting the market into a correction. The decline accelerated into the second quarter as “Liberation Day” passed, approaching bear territory (20% drawdown), something not seen in years.

International stocks took the lead while domestic stocks declined. Developed international stocks and emerging market stocks were able to benefit from more enticing valuations, making non-U.S. stocks less sensitive to disappointing news, as well as the falling dollar.

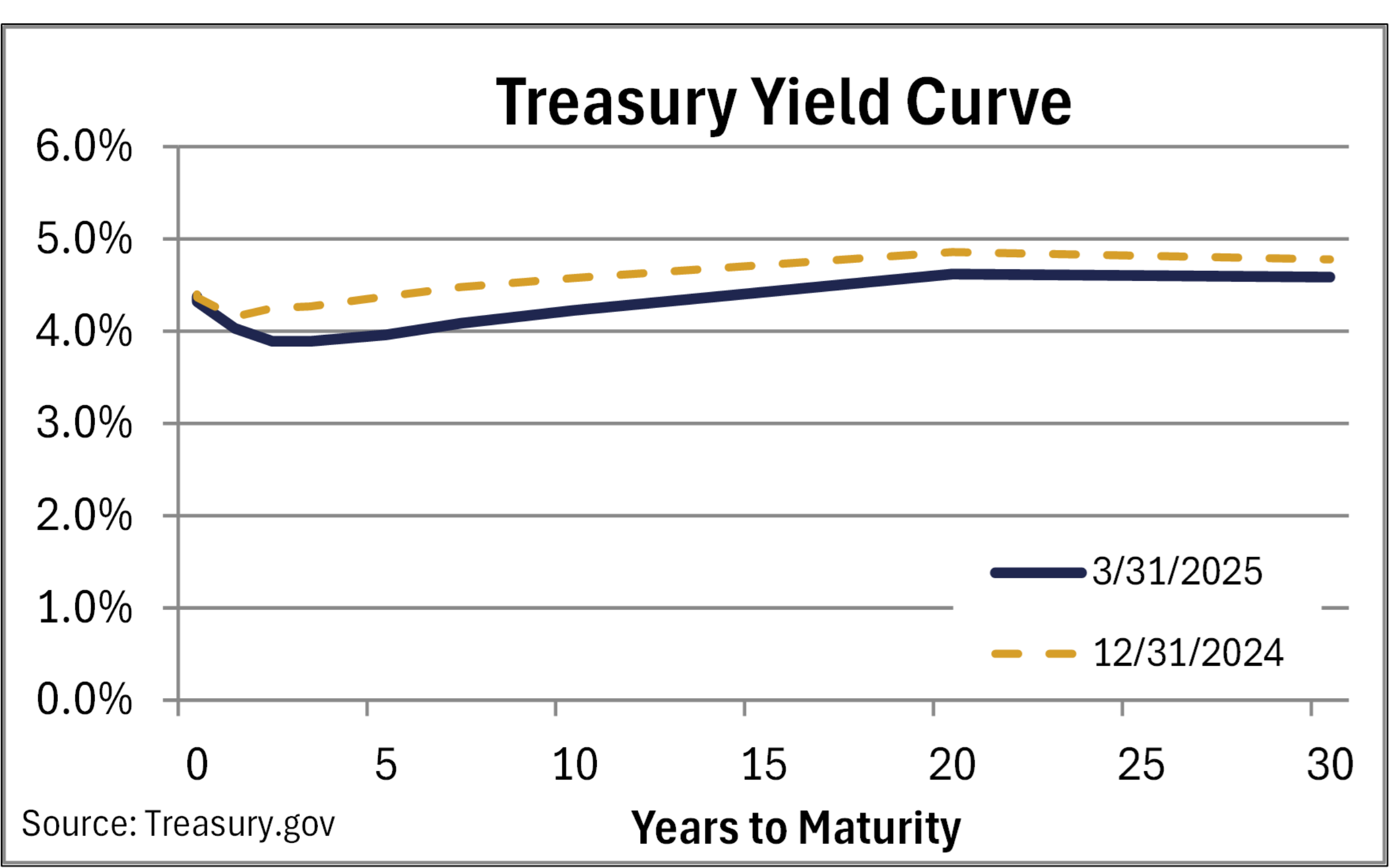

FIXED INCOME MARKETS

Fixed-income markets navigated a dynamic landscape shaped by evolving monetary policies and geopolitical uncertainties. The Federal Reserve initiated a gradual rate-cutting cycle, transitioning from restrictive to accommodative policy. This shift provided opportunities for investors to reposition portfolios and extend the duration to capture elevated yields across various asset classes. Despite macroeconomic uncertainties, the U.S. economy demonstrated resilience, with strong consumer spending driven by wage gains and stabilizing inflation. However, fiscal and trade policy shifts under the incoming Trump administration introduced new challenges, including potential tariff implementations and tax reforms.

CONCLUSION

The first quarter of 2025 drifted in on holiday cheer but ended with a dose of holiday hangovers. Investors began focusing on the specter of what may happen over what is actually happening. Surveys measuring consumer psyche took precedence over still-solid economic data. The quarter ended with a correction, not seen since the summer of 2024, and a threatening bear market, not seen for a few years. Corrections and bear markets may be scary, but they are a natural part of the investing cycle. Emotionally driven markets, such as the one we witnessed, tend to resolve themselves in a similar counter-reaction. Warmest Regards.

1 https://www.whitehouse.gov/presidential-actions/2025/01/america-first-trade-policy/

The opinions expressed are those of Heritage Financial and not necessarily those of Osaic Wealth, Inc. Forward looking statements may be subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Russell 2000 measures the performance of US small cap stocks. MSCI EAFE measures the performance of large and mid-caps of developed markets excluding the US and Canada. MSCI EM measures the performance of the large and mid-caps of emerging market equity securities. Bloomberg US Aggregate Bond index measures the performance of US investment grade bonds, including Treasuries, government agencies, corporates, MBS and ABS.

Recent Comments