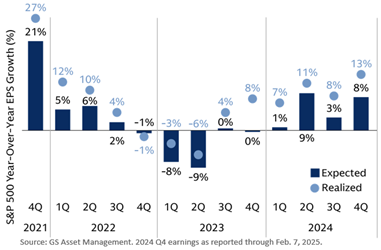

US stocks did it again. Earnings season has not yet concluded, but US companies have beat earnings expectations for the fourth quarter of 2024. A recent analysis by Goldman Sachs Asset Management (GSAM) has analyzed quarterly earnings for the past three years, and the findings are a little surprising.

GSAM found that actual published earnings often beat expectations. In most cases, there

was a wide margin. Over the last three years, the average miss was about 4%, a 54% disappointment. How could aggregate expert financial analysts dedicated to corporate and stock analysis consistently be wrong?

In short, stock earnings often exceed expectations due to a combination of strategic corporate practices, market dynamics, and psychological factors. Understanding these elements can provide valuable insights into why companies frequently report earnings that surpass analyst forecasts.

It might surprise you, but corporate chieftains often provide conservative earnings guidance. By setting lower expectations, they create a buffer that makes it easier to exceed forecasts. This practice helps maintain investor confidence and can lead to positive stock price reactions when actual earnings are reported. Additionally, companies continuously strive to improve operational efficiency, optimize processes, and utilize technology to manage costs. Successful product launches, market expansion, and increased sales can drive revenue growth beyond expectations.

Secondarily, market dynamics play a role. Economic factors such as low interest rates, strong consumer spending, and favorable regulatory environments can boost company performance. Different sectors have varying levels of predictability. For example, technology companies often experience rapid growth and innovation, leading to more frequent earnings surprises compared to more stable sectors like utilities.

Lastly, analysts use a variety of data points and models to forecast earnings, but they can be influenced by recent trends and market sentiment. If analysts are overly cautious or conservative in their estimates, companies have a higher chance of exceeding those expectations. When a company consistently beat earnings expectations, it builds a reputation for strong performance, attracting more investors and driving up stock prices.

Consumers of financial analyst projections should not take earnings expectations as gospel but as general guidance taken with the grain of salt. Though the last three years have demonstrated examples of earnings beats, other periods can render earnings misses. Portfolio strategists, much of what we do need to gain a grasp of these differences as we develop portfolios for clients.

Recent Comments