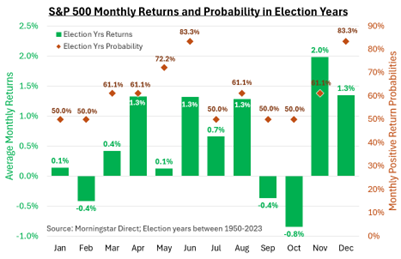

We survived it! Yes, the elections. However, I’m referring to the October’s returns. During election years, October tends to be the worst performance month with a coin flipping probability of a positive return.

During election years, volatility tends to escalate during the summer months leading up to the election. The primary reason is political uncertainty risk. As the election approaches, the campaign rhetoric increases

with investors left to weigh the election’s outcome. Polls’ ebb and flow causes investors to guess and second guess what policies may take hold over the next four years, exacerbating the market’s ups and downs.

October’s downtrodden returns are often followed by November’s upbeat performance. The first observation is a concept referred to as “return clustering.” Poor performance periods tend to be clustered with good performance periods. Historical analysis supports this return clustering notion. The best returns tend to be clustered with the worst returns. This is why investment professionals focus on long-term strategies, as the near-term volatility often dissipates. Overreacting during declines can be a mistake, assuming your long-term objectives are still intact.

The second observation is mean reversion. There is a natural flow of financial markets which gets interrupted by near-term pullbacks. Our “rubber band theory” suggests that the deeper the pullback, the greater the rebound. This works in the opposite direction as well. If markets are exuberantly propelled northward at an excessive pace, there will be a commensurate downward recoil. In the end, a mean reversion restores the markets natural tempo. Mean reversion is built into our capital market analysis.

The underlying driver of clustering and mean reversion in election years is political uncertainty. Elections are potential turning points on a myriad number of topics. Investing, being a forward-looking endeavor, requires investors to have a reasonable understanding of the path ahead to make informed decisions. If the path ahead becomes opaque, investors will opt for a bird-in-the-hand option. Irrespective of which candidate wins, certainty replaces uncertainty as the political clouds disperse.

No doubt this election cycle was full of twists and turns and many surprises. Certainly, 2024 is one cycle for the history books. Emotions tend to run high as prescriptions for our country’s challenges are debated. Yet, it’s our diverse electorate and backgrounds which makes our country so unique. It should be regarded as a source of strength and not a basis for weakness.

CRN-7267519-110524

Recent Comments