You turn on the news, hoping to hear the catalyst for such volatility. The talking heads are partially right suggesting the markets are refocusing on uncertainties. The economic data has been softening, opening the door for renewed recession prognostications. U.S. elections are less than 100 days away with some interesting twist-and-turns to date, enter U.S. political uncertainty. Not to mention, 2024 is a “super-cycle” election year with more than 70 countries holding elections. If that wasn’t enough, let’s add a pending Iranian strike against Israel potentially prompting a wider mid-East war. All this weighs on the market’s psyche.

So, what is the Yen Carry Trade? In short, investment professionals such as hedge funds or other speculative traders borrow money in low-rate Japanese Yen, then invest the money in higher-yielding securities denominated in other currencies, such as US Treasuries or Euro-denominated bonds. In effect, investors can pocket the yield difference. The assumption is that the currency exchange rates remain stable. However, since early 2023, the Yen has appreciated about 15%, wiping out the yield arbitrage.

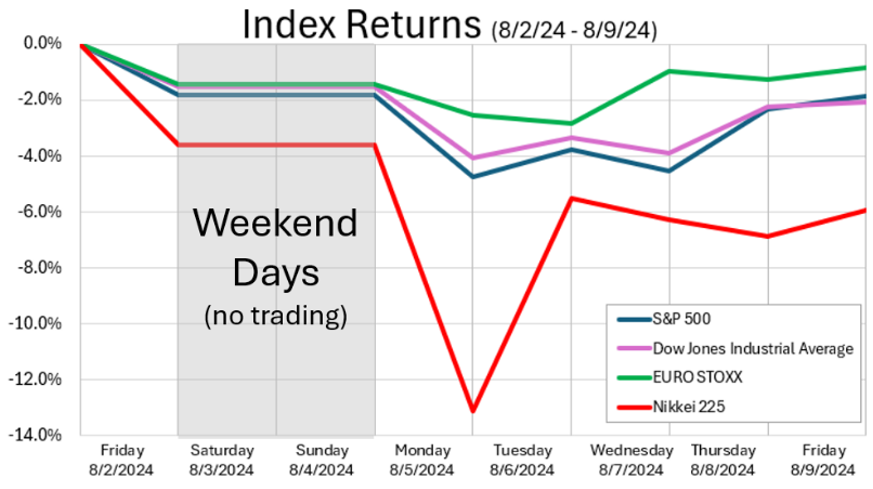

Here’s where it gets a bit hairy. Those professional investors typically use leverage to amplify returns. At some point, the leverage overcomes the yield arbitrage, requiring leverage to be reduced. This is referred to as a margin call. Margin calls force the unwinding of the Yen Carry Trade, driving the Yen’s exchange rates spiraling downward. Anything denominated in Yen gets taken for the ride, hence the 12.4% decline of the NIKKEI. This was the main catalyst for the market decline on Monday, August 5, 2024.

There is no doubt that dramatic declines are sobering. In the heat of the moment, it can be difficult to identify the cause and even more difficult to maintain a level head. It is important to note that dramatic up and down days tend to be clustered. This means that selling on dramatic down days can often lead to missed dramatic up days. The reason for this is people tend to react first and ask questions later, which often ends with unfavorable results. Keeping emotions in check is what made Warren Buffet such a successful investor. Please enjoy these last few weeks of summer. Warmest Regards.

CRN-6894664-081424

Recent Comments