Pause. After an 18-month surge for most asset classes, the second quarter was marked with less than stellar returns. The primary impetus was The Federal Reserve (Fed). The Fed’s alternating hawkish to dovish comments accompanied by fluctuating economic data whipsawed the markets.

At the same time, the Artificial Intelligence train keeps chugging ahead. “Artificial Intelligence” or “AI” web queries peaked in June, according to Google Trends1. Investment dollars have mirrored general interest as giant technology companies attracted the bulk of the attention. Microsoft, Nvidia, Meta, Alphabet (a.k.a. Google), Apple, and Amazon have enticed investors with their willingness to deploy their huge cash hordes toward AI development. The result is highly concentrated equity markets, domestically and globally. Discounting the influence of these few giants over the quarter results in a negative return for the S&P 500 index2.

The financial markets’ desire for central banks to remove themselves from restrictive interest rate policy cannot be overstated. U.S. investors’ anticipation has dwindled to just two rate cuts for 2024 from the seven expected at the beginning of 2024. At least Europeans were granted their wish as the European Central Bank and Swiss National Bank cut rates3. Near-target inflation data and early economic recovery figures may have given European central banks reason to pour fertilizer on green shoots.

On the other hand, U.S. economic data has oscillated with an overall downward trend. Economic prognostications have varied widely from “currently in recession” to “no recession in sight.” Such a wide-ranging lack of consensus is atypical. Still, financial markets cannot wait for the Fed to remove itself from the limelight.

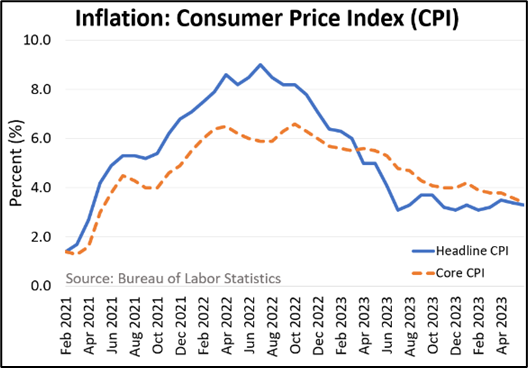

Second-quarter inflation releases witnessed data that questioned the long-term progress. Significant improvement has been made since the mid-2022 peak inflation. The most recent reading of the Consumer Price Index (CPI) was 3.3%, while the Fed’s preferred inflation measure (Personal Consumption Expenditure Price Index, or PCE Price Index) recently posted a 2.6% reading3. The Fed’s 2% target is now in sight. Our previous letters cautioned that the move to target inflation from 4% would be a bumpy 12-24 months, which is dissimilar to the descent from the peak to 4%. Hence, near-term fluctuations do not take us by surprise.

EQUITY MARKETS

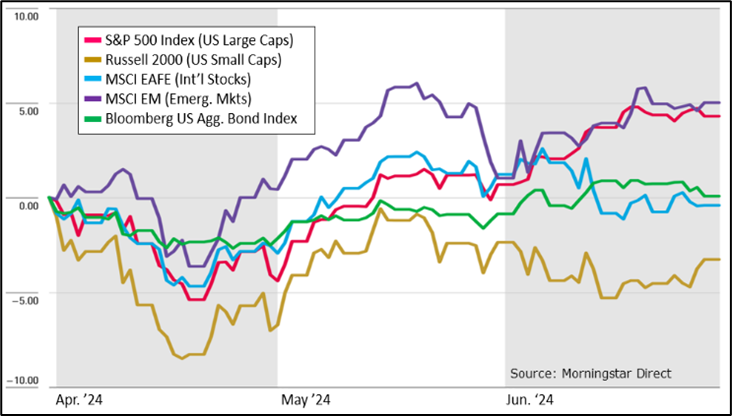

Murky economic figures gave the equity markets reason to pause the first quarter’s advance at the second quarter’s commencement. Subsequently, some asset classes advanced to new heights while others finished the quarter in negative territory. Generally, the equity market bifurcated into large U.S. stocks and emerging markets being winners while smaller U.S. stocks and international stocks left much to be desired.

Of particular note is the increasing market concentration. The seven stocks, “Magnificent 7,” which previously drove much of the market’s performance, lost a constituent, leaving just six stocks propelling the bulk of the market forward. Such concentrations have not been seen since the mid-1960s4. In 1963, the top three names accounted for approximately 15% of the market. They consisted of AT&T, GM, and Exxon. Three companies from three different industries. Today, the three top names also account for approximately 15% of the total, including Microsoft, Apple, and Nvidia. All technology names. (By the way, the fourth largest company is Alphabet, a.k.a. Google, another technology company.)

Such concentrations flow through to global indexes. The MSCI All Country World Index (MSCI ACWI) includes 2400 global companies with almost 20% weighted to just six stocks… the same six stocks driving the U.S. markets5. Historically, narrow markets signaled caution, yet narrow markets have prevailed for about 18 months.

FIXED INCOME MARKETS

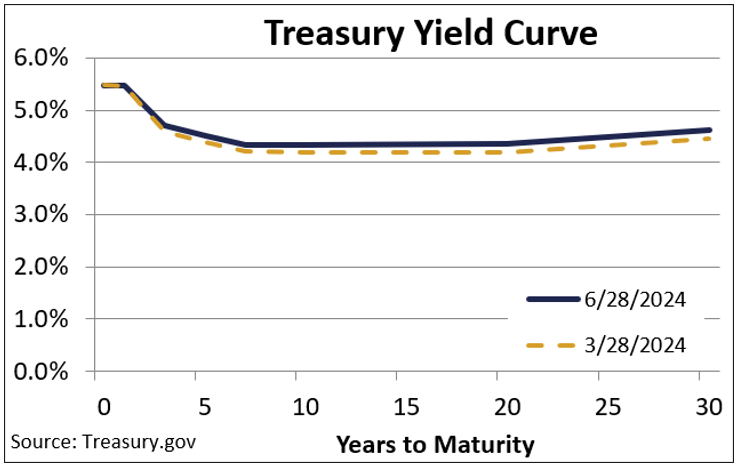

Fixed income markets were generally positive for the quarter but remained mixed for the first half of the year. Bonds yields ended close to where they started at the beginning of the quarter. Intra-quarter changes reflected vacillating economic data and the Fed’s oscillating guidance. The Fed is supposed to be a pillar of strength and wisdom. Yet, the wavering commentary seemed more like a flag wafting in the wind, offering little confidence to fixed-income markets.

Similar to equity markets, the riskier categories have earned top notches year-to-date. Lower credit quality bonds, via high yield bonds and floating rate bonds, have produced the highest returns despite warning signals. Narrow credit spreads with rising defaults accompanying softening economic data are rarely a good combination. It has been argued that the burst of “private credit” funds has attracted riskier offerings, leaving the low credit quality rankings in a better position than years past. The “it’s different this time” assertion is often an omen that rarely fulfills its promise.

CONCLUSION

Volatility has crept back into the vernacular for 2024’s second quarter, though at normalized levels. The catalyst has been the Fed’s yo-yo reluctance to exit its economic guidance. The Fed’s engineered economic slowdown is finally taking hold of financial markets, encouraging the Fed to exit its economic meddling. At the same time, the election summer has begun with polarizing candidates. The numerous polls will declare winners months ahead of the November balloting. For the near term, financial markets have to factor in political uncertainty. The second quarter was a pause for the financial markets’ 18-month upswing. Growing concerns and broadening uncertainty warrant prudent diversification and caution towards excessively utilized passive investment strategies.

1Google Trends 2Morningstar 3Econoday.com 4MorganStaley

5iShares.com

The opinions expressed are those of Heritage Financial Consultants and not necessarily those of Osaic FA. S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Russell 2000 measures the performance of US small cap stocks. MSCI EAFE measures the performance of large and mid-caps of developed markets excluding the US and Canada. MSCI EM measures the performance of the large and mid-caps of emerging market equity securities. Bloomberg US Aggregate Bond index measures the performance of US investment grade bonds, including Treasuries, government agencies, corporates, MBS and ABS.

CRN-6773511-070924

Recent Comments