The top ten remain the same. The semi-annual survey of International Monetary Fund (IMF) economists was recently published, known as World Economic Outlook. The outlook covers a number of topics, including economic developments, industry and country issues, as well as reported countries’ output, referred to as Gross Domestic Product (GDP). It is an intriguing read for interested readers, or it can be a source to break insomniacs’ routines.

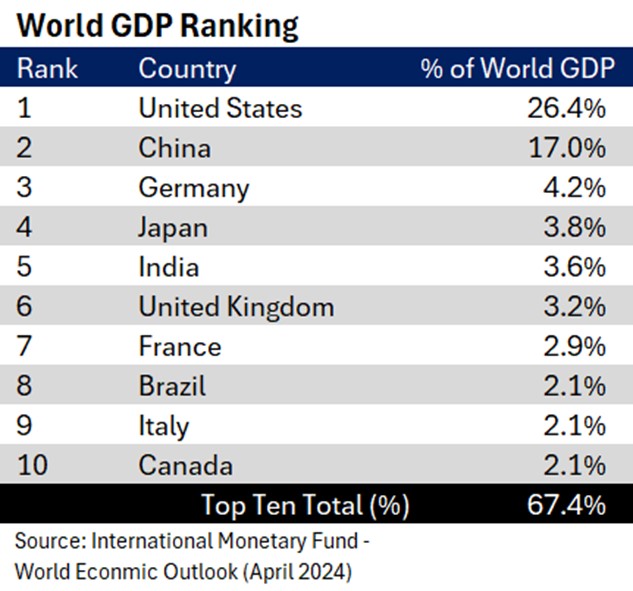

The top ten performing economies generally remain the same, though they jockey for position, with the top two positions remaining unchallenged. In total, the top 10 economies make up about 67% of the world’s economic output1. There are a few interesting changes from 2019, our last reported observation. First is Japan’s fall to 3.8% of the World’s GDP from 6.0%… falling to the fourth rank. Also, Brazil and Italy exchanged places mostly because of Italy’s fall. India stayed in fifth place but increased its weight by 0.2%.

Recent headlines have introduced a bit of unnecessary anxiety into investor’s minds, replacing the U.S. dollar as the world’s reserve currency. Could this happen? Anything is possible. Could it happen anytime soon? That prospect is not very likely. There are a number of reasons for this, but the biggest answer is the U.S. dollar is a proxy of the U.S. economy. The U.S. economy is the largest economy by far, representing more than 26% of total world economic output. Since 2019’s measurement of 24.8%, the U.S.’s weight grew even as the world’s GDP got bigger. Other factors include the stability of the political system (though current rhetoric might suggest differently), breadth/diversity of the economy, and long-running default-free history, to name a few. In short, the U.S. dollar has earned the respect and trust of international transactions.

There have been challenges in the past. The Japanese Yen was thought of as a candidate for a world currency in the 1980s as the Japanese industry was rapidly climbing. The Euro was designed to rally European countries and challenge the U.S. dollar’s dominance. Through the 2010s, the Chinese Yuan was thought to replace the U.S. dollar. None of the challengers were able to grasp the breadth, depth or resiliency of the U.S. dollar.

More recently, Saudi Arabia agreed to sell Russia oil using a non-dollar currency. Some might suggest this is a way to superficially boost the Russian Ruble’s demand. Recall, Russia defaulted in 2022, 1998 and 19182. Barely a winning track record is needed for international transactions. By the way, Russia accounts for only 1.9% of world GDP, hardly a serious challenge.

There has also been mention of a China-Russia-Iran alternative contesting Western dominance. First, these three have less than 20% of world GDP combined1, less than the U.S. alone. Second and more importantly, it can be argued these three have not acted admirably to earn respect and trust from global players. On the contrary, they have utilized strongarm tactics via threats and manipulation tactics. Though the U.S. is not without its problems, it’s fair to say it’s far more trustworthy.

At some point, the dollar’s dominance will be replaced. It’s a matter of time. But is this a threat we should worry about? The answer is not in the near term.

1International Monetary Fund – World Economic Outlook 2Financial Times

CRN-6736054-062524

Recent Comments