The economic experience differs on the other side of the pond. Post-COVID, European governments constrained spending as did its citizenry. Though a formal recession has not been declared, all the recessionary signposts are present. At some point, the U.S. should heed past European experience… austerity may be thrust upon those who lack fiscal discipline. You may recall austerity measures affecting various nation-states in the 2010s, some mandated by governing bodies while others being self-imposed. Though the austerity experiment’s success can be debated, the real-time negative economic impact cannot.

With approximately seven months to our quadrennial ritual, the primaries have set a 2020 rematch. The following months will be filled with campaign rhetoric and sensationalism. The candidates and the media may focus on ad hominem attacks, but financial markets will focus on policy declarations and assessed probabilistic impact. Too bad our political discourse has devolved into tribal warfare surpassing the open exchange of ideas.

“Hasty” is not in the vernacular of the Fed or other worldwide central banks. “Data-driven” is often used to describe their methodical approach. Central banks around the world have projected the next interest rate phase is downward, yet sticky inflation justifies the Fed’s disciplined tactic. On June 21st, Switzerland’s Swiss National Bank was the first major central bank to cut rates1. Who is next?

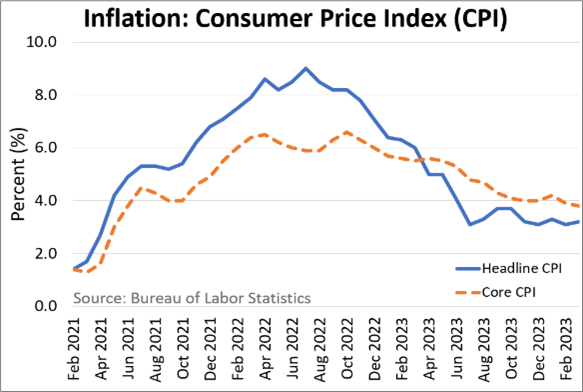

The continued spending has contributed to sticky inflation, though marked progress has been made. The move from 9% to 4% inflation was a predictable 12-month journey. In the second half of 2023, we cautioned the trek from 4% inflation to the Fed’s 2% inflation target would be choppy and sluggish. This seems to have played out. It’s a good thing the underlying data suggests target inflation is achievable.

EQUITY MARKETS

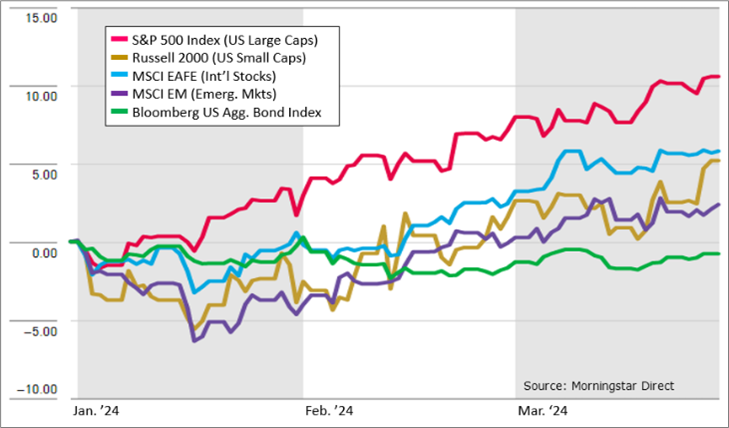

The S&P 500, the Dow Jones Industrial Average, and NASDAQ all reached new all-time highs in 2024’s first quarter. The new records were driven by the Fed, reinforcing their intent to ease interest rates at some point in 2024, with favorable corporate earnings adding to the stock gains.

All major equity markets produced positive returns, from the U.S. to broad emerging market benchmarks. Equity investors focused on central bank communiqués hinting at any type of rate guidance. Equity markets relish the day when central banks exit their economic meddling. The market’s early exuberant hope for seven rate cuts in 2024 has been tamped down to match the Fed’s expectation of just three cuts in 2024.

Rate cut guidance was augmented by solid corporate earnings and a rally in tech stocks. Elevated tech stock valuations were pushed higher due to Artificial Intelligence (AI) momentum and the promises AI can offer. While the steep tech-focused rally may be due for a healthy period of consolidation, reduced economic risks may benefit other sectors.

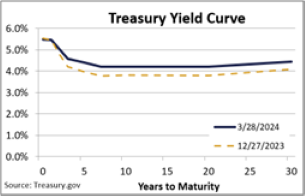

Fixed-income markets were mixed in the first quarter of 2024. Shorter term and non-investment grade bonds stayed in positive territory, mostly due to the coupon interest, while investment grade intermediate and long-term bonds’ coupons were not enough to overcome bonds’ price slide.

Going forward, investment grade bond yields give cause to attract investors’ interest, especially for municipal bonds and government agency bonds. High yield, non-investment grade bond spreads are signaling caution.

2024’s first quarter continued 2023’s momentum, economically as well as equity market performance. Fixed income markets sat on the sideline, awaiting further directional rate evidence. Global central banks have announced their desire to exit financial market influence, with market participants salivating like Pavlov’s dogs. It’s a question of timing. Will central banks time the rate cuts for a soft landing or trigger a recession? Prudent investors should mind leverage, concentrations, and highly appraised sectors. This stage of the economic cycle could prove detrimental to one’s financial health if these areas represent too much of one’s portfolio.

1Econoday.com

The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp. S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Russell 2000 measures the performance of US small cap stocks. MSCI EAFE measures the performance of large and mid-caps of developed markets excluding the US and Canada. MSCI EM measures the performance of the large and mid-caps of emerging market equity securities. Bloomberg US Aggregate Bond index measures the performance of US investment grade bonds, including Treasuries, government agencies, corporates, MBS and ABS.

CRN-6521997-040224

Recent Comments