The Iowa Caucuses formally opened our quadrennial patriotic duty… determining our federal and local leaders for the coming four years. Politics have risen to the level of sport by some and fallen to an annoyance by others.

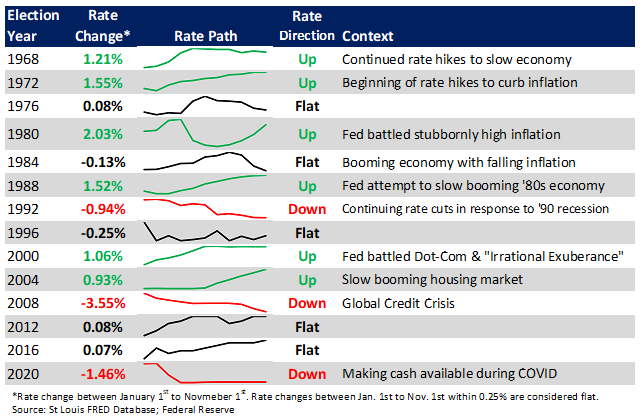

This is a special election year as the Federal Reserve (Fed) is clearly setting up for interest rate cuts. It is often erroneously acknowledged that the Fed tends to leave rates unchanged in election years as not to influence political voting. Our review of Fed rate changes differs with this myth. Since 1968, the Fed changed interest rates in 10 of the last 14 election years. Reviewing the Fed’s notes in unchanged years showed that the Fed was prepared to take rate action should circumstances warrant. So, the initial notion that the Fed is a passive spectator during election years does not seem to hold true.

Talking heads often suggest rate actions prompt political change, though not an intention of the Fed. The argument is falling rates prop up the incumbent party, while rising rates pull the rug from under its feet. However, one would be hard pressed to find a correlation between rate action and incumbent party success.

No doubt, the next 11 months will be a difficult trail for the Fed to clear. After all, the Fed is still trying to engineer a soft landing with critics from various perspectives casting wide prognostications. Since the summer of 2022, the Fed has made tremendous progress, yet obstacles remain. Of note are consumers still spending money via additional credit card load. The labor market has softened, just not to the liking of the Fed. Lastly, investors are expecting twice as many rate cuts in 2024 than being projected by the Fed. The political backdrop only seems to complicate matters.

The Fed has always aimed for impartiality. A review of Fed action over the years supports such an objective. The driver of rate changes is economic performance as dictated by inflation and employment progress. Hence, the context is what’s important. Current day context indicates weakening economic activity with inflation moving towards the target suggesting the Fed will ultimately need to soften its stance.

It seems political emotions have become more intense over the years. Our differences are what has contributed to the strength of our nation and shouldn’t be viewed as the reason for its demise. Over the next 12 months, we should commit to recognizing different political leanings do not equate to evil intent; simply differing views result from different prescriptions to complex issues.

CRN-6240791-011724

Recent Comments