One of the biggest questions facing bond investors is, “What is the bond market telling us?” The bond market is often thought of as the nervous nelly of the financial markets. Afterall, bond investors are concerned with a return of their capital upon a bond’s maturity. This is a stark contrast to equity investors which tend to look for opportunity. Due to the bond market’s pessimistic nature, macro yield analysis could offer insight into what may lay ahead.

First, let’s talk about perspective and context. Fixed income investors focus on the 10-year treasury as an economic progression barometer. The importance of the 10-Year is pretty straight forward. Many loans are based off the 10-Year Treasury; be it mortgages, business loans or construction loans.

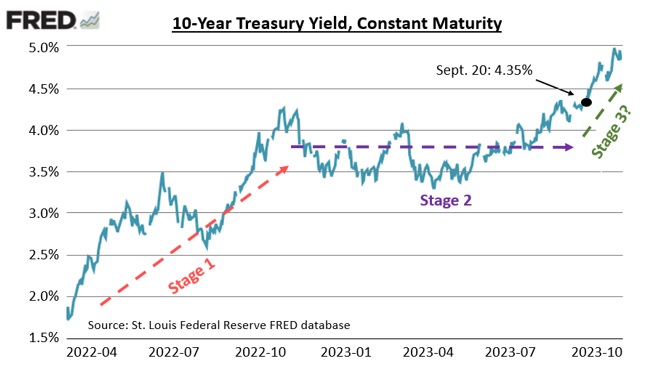

Analyzing the 10-Year Treasury during Federal Reserve (Fed) tightening cycles reveals three general stages.

- An intense upward movement corresponding to the Fed’s rate hikes.

- A sideways movement as the bond market attempts to assess the Fed’s final rate.

- A “blow off” stage with a sharp move higher near the final Fed hike.

The Fed’s latest rate hike cycle, between March 2022 and current day, seems to correspond with this historic norm. Admittedly, each stages’ duration and intensity vary with each cycle, yet historical norms offer a general roadmap of what may lay around the corner.

The third stage is followed by ultimate rate decreases. This seems logical as rate hikes are purposefully designed to slow the economy. Think of stop-and-go traffic. You need to brake a little harder than the overall traffic pace to avoid hitting the car in front of you. Once there is enough room, you can depress the accelerator to close the gap. Effectively, that is what the Fed is doing. The Fed raises rates higher than needed to slow the economy but will ultimately need to speed the economy up when there is enough leeway ahead.

The strong upward movement since late September gives all the makings of stage three. However, the future is unknown, and cycles vary. As such, using this historical pattern as a market timing device is not recommended. It does provide some insight as to what may lay around the corner, especially as the financial markets struggle with the final rate hike timing. The Fed has surprise just about every professional investor over the past 18 months with surprise hikes leading to 2022’s dismal performance. In the meantime, it’s best not to abandon your bond allocations as 2023 is not turning out to be a repeat of 2022.

CRN-6065963-110123

Recent Comments