Year-end gives us a natural break for us to take stock of accomplishments and determine which items to be pushed into next year. Estate planning tends to be an area where we procrastinate taking action as there is rarely incentive immediacy. Our ultimate destiny will come someday, but not likely tomorrow.

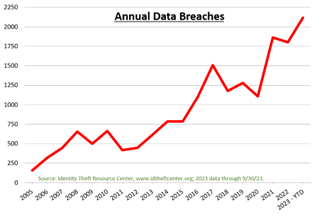

Another willfully ignorant aspect is the growing threat of identity theft. Identity theft happens when someone uses your personal or financial information without your permission. It can damage your credit status and cost you time and money. Identity theft often falls into the realm of, “it won’t happen to me.” The reality is it has likely already happened to you… you just don’t know it. Statistics show data breaches are not losing steam. In fact, 2023 (through Sept. 30) has had more data breaches that any full calendar year in history! Given our technology trajectory, this is not likely to be a problem that resolves itself.

Similar to identity theft is identity fraud. With identity fraud, victims remember interacting with the criminal. A recent growing fraud deals with the fraudster impersonating one’s grandchild asking for money to resolve an issue. Be on guard for voices dissimilar to your grandkids and/or atypical personal nicknames or phases.

The first step in protecting your identity is to be aware of the problem and admit you are not immune to it. To protect yourself, you need a level of skepticism and awareness.

- Do not answer calls, texts, social media messages, or email from numbers or people you do not know.

- Do not share personal information, i.e. bank account number, Social Security number, or date of birth.

- Collect your mail every day and place a hold on your mail when you will be away from your home.

- Review credit card and bank account statements. Watch for unauthorized or suspicious transactions.

- Store personal information in a safe place, including your Social Security card.

To guard further against identity theft, you can enroll in an identity theft protection service. Generally, these services offer personal data monitoring services, locking down one’s credit report, and can assist with identification recovery. Such firms include Aura, Lifelock, Identity Guard, IdentityForce, and IdentityIQ to name a few. Cost tends to be a couple hundred dollars annually. For full transparency, we have no affiliation, compensation arrangements or referral agreements of any kind with any identity protection service.

Identity theft has grown into its own industry and has become a risk of modern life. As the year draws to a close, it may behoove you to employ enhanced vigilance in this area. Best wishes during this holiday season.

CRN-6140832-120523

Recent Comments