The final quarter of 2023 was ushered in with balloons, confetti, and celebration. All it took was the Federal Reserve (Fed) to finally confess what the market was waiting to hear… interest rate increases would be no more. The Fed’s exit from economic engineering came at the conclusion of October, leaving November and December to break out the party favors.

November turned out to be one of the best months on record for both stock and bond markets. The springboard effect suggested financial markets were primed for the Fed’s announcement. Bears calling for an early Santa Claus rally were disappointed as the rally continued through December.

Ironically, financial market reaction was accompanied by mostly deteriorating economic fundamentals, reinforcement that equity investing is not synonymous with economic activity. Most U.S. and international manufacturing indexes have been contracting1. As months pass, houses are taking longer to sell with fewer and fewer houses being sold2. Layoff announcements have remained high throughout 20233, though layoffs have been offset by job gains. Most layoffs permeate the white-collar office workers, atypical of most recessions where front line and blue-collar workers receive the brunt of layoffs.

Economic activity has been kept in the positive territory primarily due to consumer spending. “Buy now, pay later,” has become the mode of choice. Be it products or services, spending is being placed on credit cards. Aggregate credit card debt has ballooned to over $1 Trillion4. The generational shift away from cash may be a contributing factor, yet a recent Forbes survey found respondents expecting holiday spending to swell their credit card debt5. Consumers living on borrowed money can only go so far. In fact, credit card, auto, and mortgage delinquencies have begun the migration northward6.

Foreign central banks have followed the U.S. Federal Reserve ceasing their respective rate increases, boosting their financial markets in a similar fashion. The next step for central bank economic planning is rate cut timing. Financial markets are generally pricing in rate cut commencement mid-way in 2024.

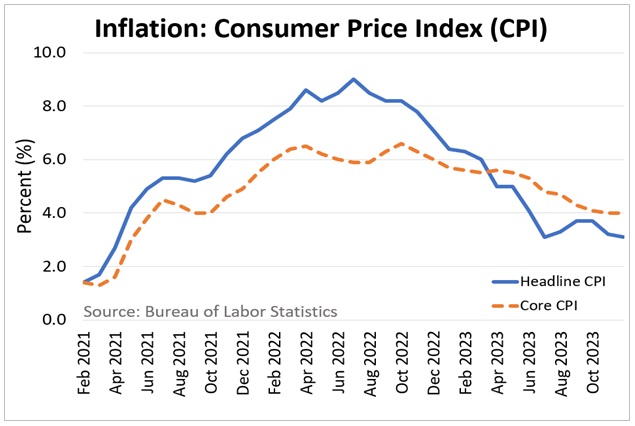

INFLATION

Inflation has garnered the Fed’s primary focus over the past two years. Understandably, not repeating the ‘70s stagflation was top of mind. With inflation mostly under control, or at least clearly moving towards acceptable levels, the Fed is close to claiming victory. Sticky inflationary aspects remain, needing continued monitoring, while lagged effects, mainly housing inflation, should not be mistaken as sticky. Though not a fait accompli, significant progress has been made.

EQUITY MARKETS

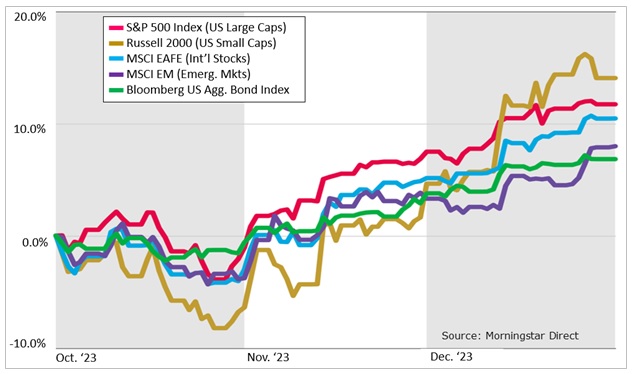

Equity markets boomed with excitement as the Fed confirmed no more meddling. Various stock market indices, many in negative territory upon the quarter’s onset, were thrust into the green. Patient investors were happily rewarded.

Stock market concentrations haven’t been this high since the mid ‘70s. The “Magnificent 7” stocks (Apple, Amazon, Alphabet (a.k.a. Google), Meta (a.k.a. Facebook), Microsoft, Nvidia, and Tesla) led the way bringing their already high valuations to stratospheric levels. These stocks have attained a cult of personality status, emotionally tying investors. Investors of these companies should be cautioned; companies can’t reign forever as darlings can often become fallen angels.

The quarter’s rally pushed the Dow Jones Industrial Average to new highs, almost two years after its previous all-time high. The S&P 500 was a stone’s throw from its all-time high. The recovery path was punctuated with considerable volatility, but the two-year peak-to-peak would be considered a fairly quick turnaround. Smaller U.S. companies as well as international stocks still have ground to make up to post new highs.

Emerging markets posted positive gains for the year. Ex-China indices fared much better than general emerging markets indices, which generally have about a third in Chinese stocks. China elimination/mitigation continues to be a driver of our emerging market exposure.

FIXED INCOME MARKETS

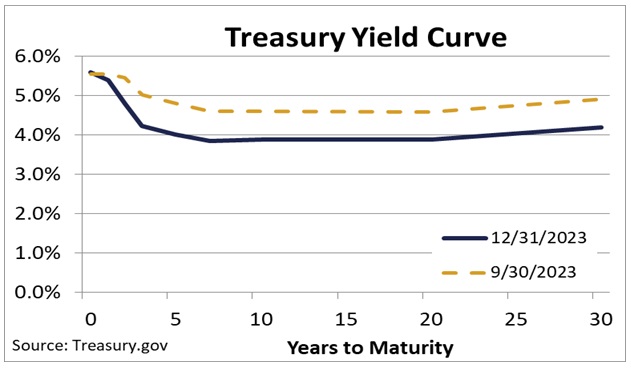

Fixed income markets continued high correlations to equity markets enjoying a similar catalyst to positive performance. Intermediate and long-term bond yields fell more than 1% from the October 31st peaks. Falling yields are inversely related to bond prices, giving bond performance one of the best months on record and moving bonds from slight negative YTD returns to finish the year with positive performance.

Cash and cash equivalents, heavily driven by the Fed’s interest rate policy, have remained high. Many money markets offer yields around 5%7. It is important for investors not to become too enamored with current cash equivalent yields as cash yields float. Money market yields will follow the Fed’s lead when the eventual cuts come. For now, investors should enjoy these higher yields.

The fourth quarter was welcomed after the third quarter’s volatility. Market observers could tell the market was in the starting blocks waiting for the eventual trigger… the Fed’s declaration that rate hikes were over. Timing was the only question. With the sprint of the last two months, the financial markets may need a breather. A lot of progress has been made in a short period of time. We look forward to the start of a new year with new opportunities and new hopes.

1 Econoday.com

2National Association of Realtors

3 The Challender Report

4 New York Federal Reserve

5 ForbesAdvisor, https://www.forbes.com/advisor/credit-cards/holiday-spending-trends-2023/

6 St. Louis Federal Reserve

7 Morningstar

The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp. S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Russell 2000 measures the performance of US small cap stocks. MSCI EAFE measures the performance of large and mid-caps of developed markets excluding the US and Canada. MSCI EM measures the performance of the large and mid-caps of emerging market equity securities. Bloomberg US Aggregate Bond index measures the performance of US investment grade bonds, including Treasuries, government agencies, corporates, MBS and ABS. CRN-6188925-010224

Recent Comments