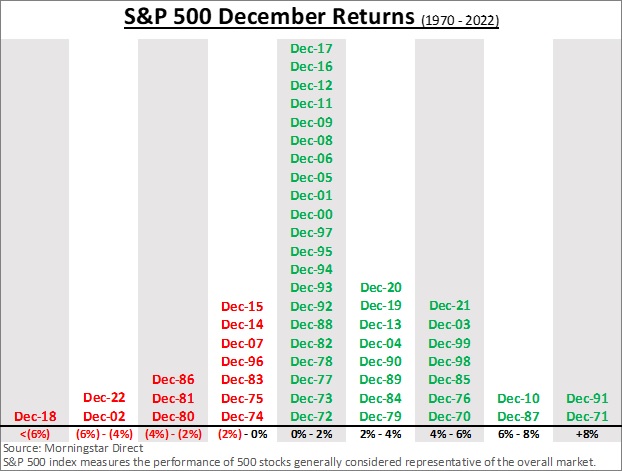

The final month of the year is often accompanied with feelings of joy delivering positive returns to investors. Since 1970, a Santa Claus visited the stock market 75% of the time1. Due to the high occurrence of positive returns which are occasionally accompanied by high single digit returns and even a double-digit return, the holidays have adopted the term “Santa Claus Rally.”

The best Santa Claus Rally occurred in 1991 with a return on 11.4%1, which was complemented by the USSR President Gorbachev’s resignation, the dissolution of the USSR, end of the decades long Cold War, and “peace dividend” declarations. The worst December of -9.0%1 happened in 2018 due a few unknowns; US-China trade war concerns, BREXIT’s back-and-forth negotiations, prognostications of economic weakness, and Federal Reserve Chairman Powell suggesting continued rate hikes for 20192.

December 2023 has not yet been written. Will Santa Claus visit the market this year? It’s possible Santa came early with very strong November performance. November resulted from Federal Reserve Chairman Powell mentioning the approaching rate hike cycle conclusion followed by economic data supporting Powell’s words were sincere and not another head fake.

The data is clear. December tends to be a good month for patient investors, though there are no guarantees. Reasons for favorable Decembers still leaves inquiring minds in a lurch. Maybe Santa’s lesson is a positive outlook is more productive. Ho, Ho, Ho!

2https://www.pbs.org/newshour/economy/making-sense/6-factors-that-fueled-the-stock-market-dive-in-2018

Past performance does not guarantee future results. Forward looking statements may be subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied.

CRN-6127049-112923

Recent Comments