Warren Buffett got it right, “Investing is easy, but it’s not simple.” Buffett was addressing the goal of buying low and selling high, yet the actual decision making and timing are quite difficult. Stock movement is often tied to the economic progress, which seems logical. If the economy is growing, stocks should be appreciating and vice versa. Unfortunately, this is a logical fallacy.

In some ways, the economy is like the tide. As the tide comes in, it raises all boats. Under the same logic, all boats should run aground when the tide recedes. If this were the case, all companies would fail at the first economic challenge. The reality is many companies have existed for many decades and some longer than 100 years. How can that be? What else is at work?

In the same way the tide is the economy, boats are individual companies captained by a management team. That team is responsible for piloting their companies, moving their boat to deeper waters when conditions present themselves. Investors’ end game is to assess management’s ability to generate earnings, especially during difficult times. There in lines the missing link… earnings.

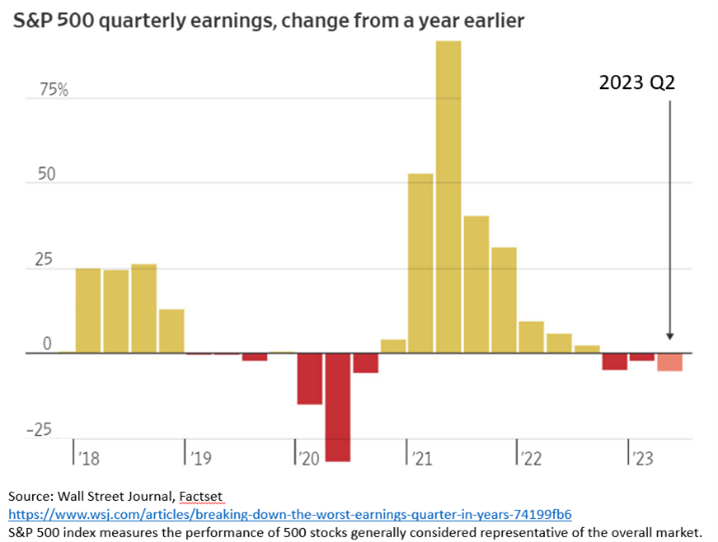

At the end of the day, stock prices are simply a reflection of earnings, or more specifically earnings growth. During the previous three quarters, earnings growth contracted. This was primarily due to rising interest rate effects on earnings. Stocks are said to be forward looking. Meaning, investors attempt to value future earnings and earnings growth given known information. Sudden assumptions changes, such as abrupt interest rate hikes, cause investors to reassess assumptions which is seen as stock market volatility.

Much of 2022 can be explained by the earnings construct. Stocks began declining in early 2022 in anticipation of higher interest rate effects on earnings. Many times, throughout 2022, the Federal Reserve altered their communicated interest rate path with unexpected raises, resulting in stock market volatility as investors had to adjust their future earnings assumptions. In sum, 2022 earnings ultimately did not meet initial 2022 projections, specifically between 2022-Q4 through 2023-Q2.

As earnings season for the third quarter 2023 begins, announcements and forward guidance has been positive even with deteriorating economic backdrop. In most sectors, enhance expense control has contributed to higher profits. Companies that have controlled their expenses are akin to ship captains maneuvering their vessels for deep water as the tide recedes. As important as the economy is, stock prices appropriately reflect management’s effectiveness to generate and grow profits irrespective of the economic environment. Hence, economic softening should not prompt stock divestiture. It’s easy to equate stock appreciation with the economic cycle, but it simply is not the case.

CRN-6050705-102523

Recent Comments