Shutdown averted… for now. Government shutdowns are not new. In fact, they happen far more frequently than many realize giving talking heads the opportunity to ruffle feathers.

Ensuing government shutdowns are simply a political impasse on spending priorities. Shutdowns are purposefully designed as federal debt approaches agreed upon levels to force congressional representatives to debate spending priorities and deficits. Government shutdowns are often touted as the government running out of money, implying the modern life stops. The reality is the U.S. government is the ultimate producer of money. Need more cash… just fire up the printing press.

The consequences of too much debt will ultimately have negative ramifications. To simplify things, think of a household that carries debt, say $100k. If the household only earns $25k annual, ultimately the household will have to file for bankruptcy even if they can make interest payments in the near-term. If the household earns $200k, the $100k debt is not a problem.

At this point, the U.S. federal debt is about 120% of U.S. Gross Domestic Product (GDP)1, or the country’s aggregate earnings. The problem arises with annual Federal spending exceeding annual Federal tax receipts by trillions. The annual deficits are added to the existing debt substantially increasing the debt every year. Go back to our household example, adding $25k each year turns $100k debt into $350k in 10 years jeopardizing even the high-income household. That spending level ad infinitum is not sustainable.

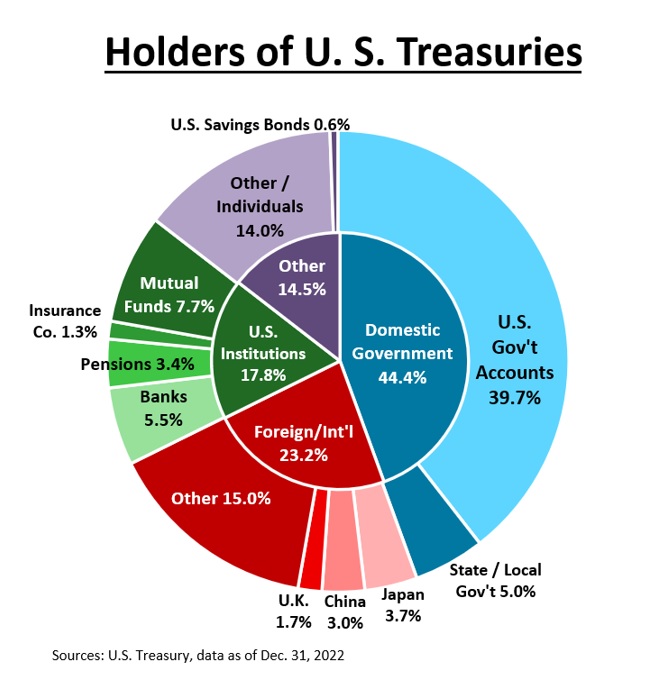

An impending shutdown motivates the news cycle to present corollaries. An often-presented topic is foreign holders of U.S. debt. Foreign holders of U.S. Treasuries are easy pickings, specifically as it relates to our economic and military rival, China. Media readily depicts the U.S. is beholden to foreign holders. The reality is foreign holders account for only 23% of U.S. Treasuries in aggregate, with China accounting for a scant 3%. These levels hardly justify subjugation by foreign holders.

One question to ask is, “why do countries hold U.S. Treasuries?” In short, the U.S. is the backbone of the global financial system. This is based on the size, depth, and breadth of the U.S. economy as well as its historical financial dependability. You may have heard of the dollar as the global reserve currency. U.S. Treasuries are globally considered risk-free making Treasuries foundational to financial instruments.

Coming full circle, should the U.S. government default on its obligations, the global financial system would be thrown into a quagmire. Politicians on both sides are aware of the ultimate ramifications making government shutdowns mostly partisan brinkmanship. Next go around (which could be mid-November), remember politicians don’t want a global financial crisis on the hands, effectively ensuring a slim-to-no U.S. default often suggested by the media.

1 St. Louis Federal Reserve FRED database

CRN-6023951-101623

Recent Comments