Market volatility articles are often presented in response to volatility spikes not in anticipation to them. Understanding volatility can help you become a better investor.

Financial markets, especially the stock market, are in a constant state of flux. There has never been a trading day when stocks have remained stagnant. Financial markets are “negotiated” markets with investors buying and selling financial securities. “Negotiated” meaning every transaction is actively bargained. Negotiated transactions seem a little bit obscure given the industry’s push-button lightning speed execution, but negotiated transactions drive financial markets and its volatility.

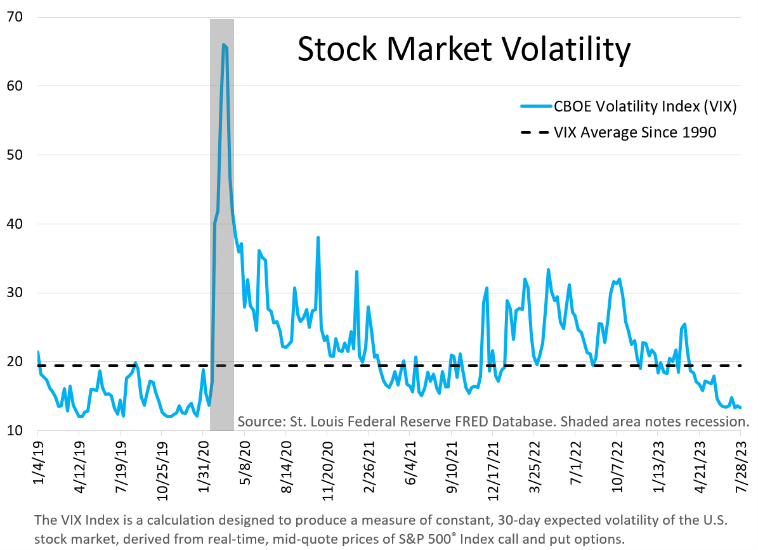

Volatility spikes are a result of new information, typically unexpected and often negative, which cause investors to reevaluate financial security prices. New information could include direct financial market influences (such as, interest rates or earnings) or esoteric changes (such as, hurricanes or geopolitical strife). Interestingly, high volatility can often beget higher volatility due to investor anxiety. Understanding the historical context can ease investor anxiety when the inevitable happens.

As previously mentioned, financial markets are in a state of flux. Gyrations come in daily, weekly, monthly and annual movements. Naturally, volatility levels spend time above and below the long-term average. Afterall, an average is just that. At extremes, volatility can be considered contra-indicators. Very high volatility will eventually calm. Calm volatility will eventually lead to unrest. Internalizing the ebb and flow of volatility and how it relates to the long-term average can help mitigate one’s investing anxiety.

Currently, stock market volatility has been on a downward trend moving towards the lower end of its natural range. Calm is often accompanied by complacency. Complacency is when investors become too comfortable with the status quo to postulate potential future risks. So, when risk appears, investors are flatfooted.

On average, -5% declines occur three times a year1. So far this year, we’ve only experienced one. Decline norms coupled with near range bottom low volatility suggest complacency rules the day. A decline in the future is not out of the question. At the same time, historic norms are not absolutes, and these can’t be viewed as market timing triggers. Yet, recognizing volatility’s current state as well as its natural ebb and flow could mitigate anxiety when higher volatility occurs.

Volatility is an inevitable part investing not to be scared of. Volatility is the ultimate reflection of risk. Without volatility, there is no risk. Without risk, there is no possible reward beyond risk-free cash. Keeping volatility in perspective helps levelize investing temperament.

1https://www.capitalgroup.com/individual/insights/articles/market-corrections.html

CRN-5868972-080923

Recent Comments