FOMO can be a No-No. FOMO is a fairly recent acronym standing for “Fear of Missing Out.” It is an attempt to characterize the human innate desire to be accepted. FOMO is a way to characterize the psychological influences on investing, or behavioral finance.

The foundational aspect of investing is to buy low and sell high. After all, the ultimate goal of investing is to have your money work for you. Investing is a logical endeavor, but human emotional tendencies can corrupt those logical decisions, which happens to also be a fundamental cause for market volatility. It is often said markets are driven by fear and greed.

Investing history is crammed with FOMO examples. More recently was the work-from-home theme. During COVID, market prognosticators announced the commencement of a new world paradigm consisting of virtual meetings and flex schedules in lieu of traditional offices environments and work agendas. They were partly correct in that new future work will entail some level of avant-garde thinking. Predictably, investors wanted to jump on the future vision. Seems logical. Where investors (professional and amateur alike) go wrong is snubbing reasonable, common-sense evaluations pushing valuations to unsustainable levels.

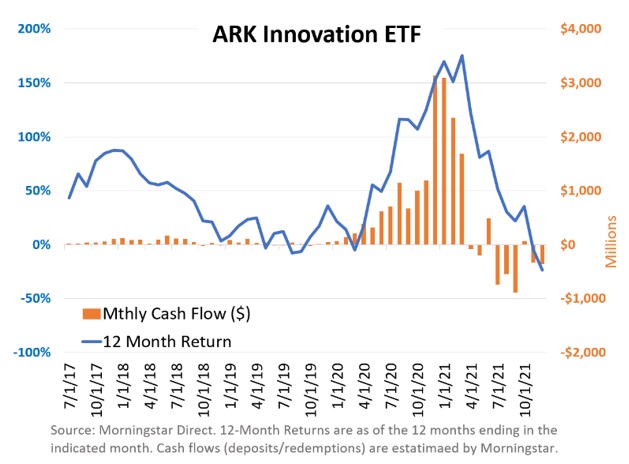

A large benefactor of the work-from-home FOMO was the ARK Innovations ETF (symbol ARKK). The fund was established in 2014 designed to invest in innovative and disruptive technologies. Until late 2020, the fund had very little interest often entertaining speculative bets. COVID brought on a perceived paradigm shift as work-from-home was the way of the future. ARKK was in the right place at the right time to receive a flood of investment dollars. Unfortunately, such interest came towards the end of a huge runup. Regrettably, many investors, piling in after the bulk of the runup, lost money. Their decisions were led astray by their FOMO. ARKK is only one example of FOMO taking hold.

What’s the lesson? Be very careful of a recent “trend,” “a sure thing,” or what everyone else is doing. Be very wary of your own personal FOMO. It’s an impulse embedded in deep our psyche. Wise sage Warren Buffett has often cautioned against overly optimistic forecasts.

Side note: The NASDAQ 100 index is undergoing a “special rebalance” which has only happened twice before. The concentration of the top five stocks (Microsoft, Apple, Alphabet (a.k.a. Google), NVIDIA & Amazon) accounted for 46.7% of the index. To reduce concentration, the NASD has employed a new top-five-limit to just 38.5%, redistributing roughly 8% to smaller companies. New weights were announced on Friday, July 14th and were implemented on Monday, July 24th.

Recent Comments