Many have heard of cycling’s pinnacle race, the Tour de France. The Tour de France is a 21-day race totaling more than 2000 miles traversing the flats, mountains, and cobblestones of French roads. The cyclist with the fastest overall time is marked with the coveted “yellow jersey.” The yellow jersey indicates the cyclist to beat, which can be transferred to a new leader as the days progress. Effectively, the yellow jersey means you are winning, while knowing the race isn’t over.

At this point, the Federal Reserve (Fed) has earned the yellow jersey. So far, the Fed is winning by bringing down inflation and keeping employment high without sparking a recession. Though the race isn’t over, the Fed can boast of its successful early leadership successes.

The second quarter rebounded off the regional bank defaults in the first quarter and international consternation in the first quarter. The global economy has managed to avoid a recession in recent months, thanks to resilient consumers, a surge in travel and leisure activities, and the reopening of China’s economy following pandemic-related lockdowns. Interestingly, China’s most recent data suggests their reopening may be fading as much of the globe has preferred leisure and experience spending over buying more goods and products, hurting China’s economy which is reliant on producing and exporting those goods.

Traditional economic markers have signaled the current cycle is long in the tooth1. Initial weakness can be seen via the downturn in housing and manufacturing as well as receding corporate earnings. Labor market retrenchment and consumer spending tend to be some of the last aspects to confirm the economic stage. Weakness in both have appeared through layoff announcements and diminished spending.

Over the past three months, exogenous shocks had little effect on the financial markets. The much-ballyhooed U.S. Debt Ceiling deadline passed via political agreement and without default, following historical precedent2. OPEC announced oil productions cuts which failed to elevate oil prices. Finally, Russia’s short lived coup attempt did little to ruffle the financial markets.

INFLATION & RECESSION

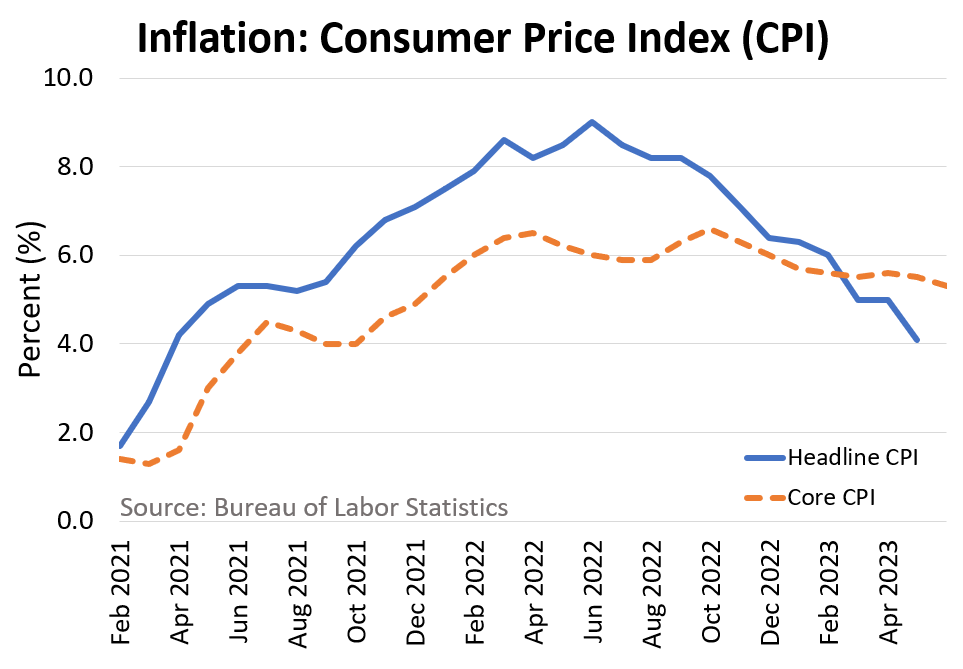

Inflation’s threat exhibited further retrenchment. Throughout the quarter, inflation’s descent dropped to its lowest point since April 2021. This comes as a sigh of relief to equity and bond investors alike as they anticipate the Fed pausing rate increases. Core Inflation (inflation ex-food and energy) has remained sticky. Much of the “stickiness” comes from the shelter component, which tends to have a lagged effect. For example, housing prices and rents began their decline earlier this year, well after inflation’s peak during the summer of 2022.

The Fed is attempting to thread a needle. So far, it appears the Fed has been successful bringing down inflation without triggering a recession. Consumption has centered around leisure and travel as opposed to the acquisition of goods and products. Positively notched consumer spending seems to be more closely

tied to the arrival of summer vacation with worry about an economic downturn being pushed aside, or at least ignored for now. Since the U.S. economy is approximately 2/3rds consumer spending, summer spending desires have kept the economy from slipping into recession. A big concern is the economic path upon summer’s conclusion.

EQUITY MARKETS

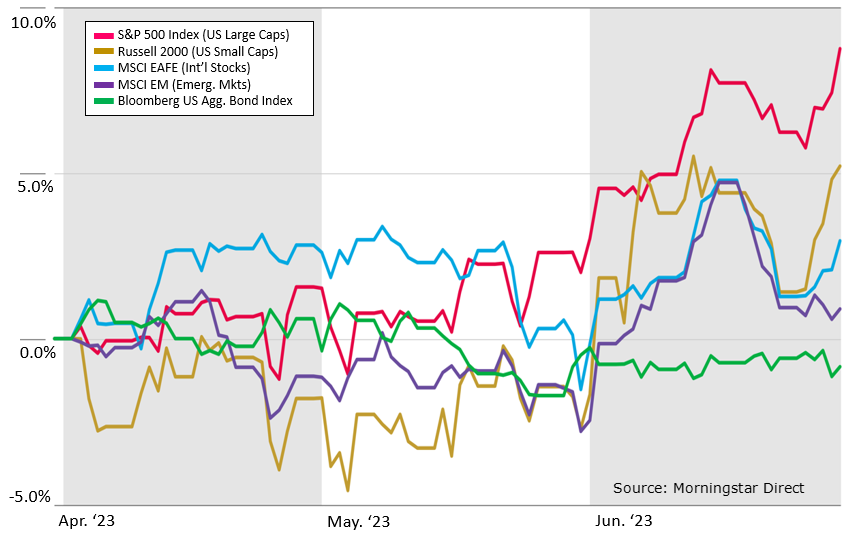

Equity markets notched their third consecutive positive quarter. The surge followed the first quarter ending on a sour note, though positive for the quarter, with positive economic data to bolster spirits. Debt Ceiling resolve and the first Fed’s rate pause of this cycle gave investors more reason to push stock prices higher.

The domestic stock market advance was focused on the “Magnificent Seven,” the seven of the largest U.S. stocks. These stocks are well known companies, including Alphabet (a.k.a. Google, which has two share classes), Amazon, Apple, Meta (a.k.a. Facebook), Microsoft, and NVIDIA. Adjusting for the market’s narrowness revealed a far less robust stock market advance.

International stocks witnessed a similar disparity with Japanese and Indian stocks garnering most of investor’s attention. European stocks experienced an advance early in the quarter, giving way to indifference, as diminished economic data suggested European nations were further along the economic cycle than expected.

The world’s second largest economy, China, was one of a few countries that faced a falling stock market from the quarter’s commencement. China’s re-opening surge appears to have fizzled as Chinese citizens shore up their finances as opposed to spending their cash. Additionally, developed nations populations have chosen to spend their money on experiences versus goods, providing a headwind to Chinese exports.

FIXED INCOME MARKETS

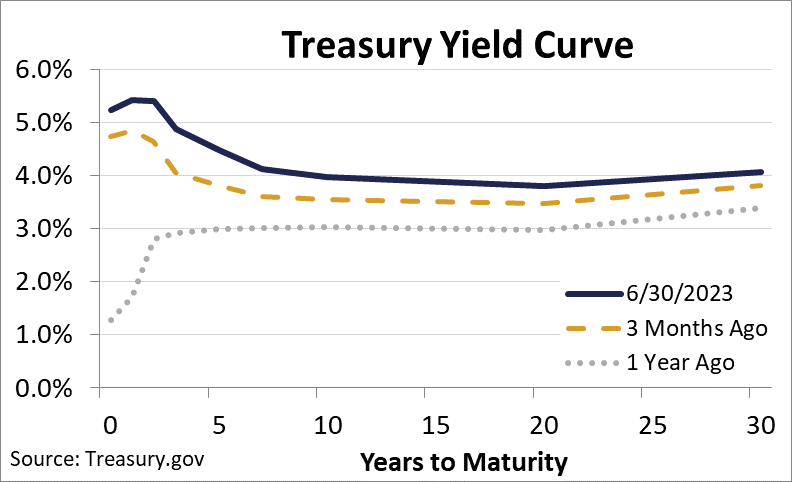

Investment grade bonds drifted a little lower throughout the quarter yet remained positive for the year. The decline mostly came from deliberation following Fed Chairman Powell’s comments after May 3’s rate increase. Powell’s “hawkish hold” comments on May19th3 helped ameliorate bond investors’ anxieties, but the damage had been done.

With three consecutive positive quarters behind us, the pain of 2022 has dissipated to a waning memory. Discipline and focus help mitigate knee-jerk reactions to inevitable short-term market swings. Don’t forget, the most successful investors don’t let the short-term challenges distract from the long-term objectives. Have a wonderful summer.

1 https://www.clearbridgeinvestments.com.au/perspectives/anatomy-of-a-recession/

3 https://www.ey.com/en_us/strategy/macroeconomics/fed-chair-powell-speech-may-19

The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp. S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Russell 2000 measures the performance of US small cap stocks. MSCI EAFE measures the performance of large and mid-caps of developed markets excluding the US and Canada. MSCI EM measures the performance of the large and mid-caps of emerging market equity securities. Bloomberg US Aggregate Bond index measures the performance of US investment grade bonds, including Treasuries, government agencies, corporates, MBS and ABS. CRN-5785897-070323

Recent Comments