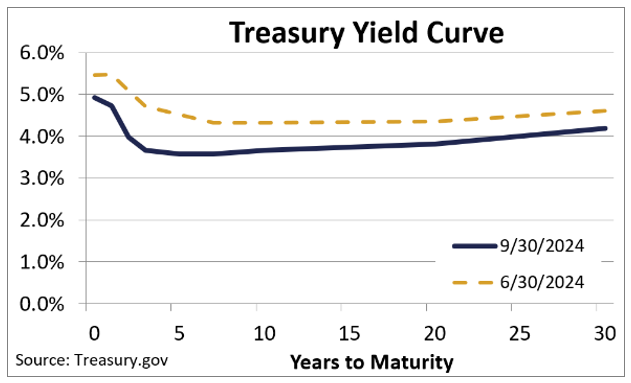

Early in the quarter, the Federal Reserve’s (Fed) decision to maintain interest rates was a pivotal event, reflecting a cautious optimism about moderating inflation and a steady labor market. As the quarter progressed, a deteriorating labor market picture led to heightened concern about the health of the broader economy giving the Fed reason to bring rate cuts in mid-September.

Artificial intelligence (AI) euphoria enabled the S&P 500’s comeback after the 2022 bear market; the initial high gave way to reality. Since midyear, top-performing tech stocks have also taken a back seat to more rate-sensitive and economically resilient areas of the market that had underperformed during most of the Fed’s tightening cycle. Among those laggards that have now taken the lead in publicly listed global infrastructure.

Geopolitical uncertainties, particularly related to conflicts in Europe and Asia, further added to market anxiety, prompting a cautious approach among investors. This environment of heightened volatility resulted in sharp intraday swings in both equities and bonds, as market participants remained focused on upcoming economic indicators and their potential implications for future monetary policy.

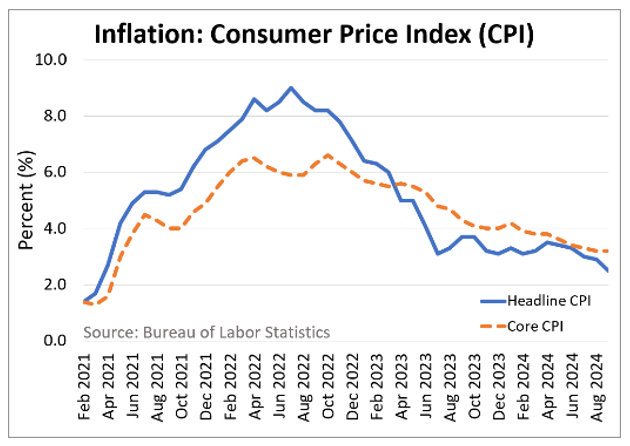

Inflationary pressures showed signs of moderating, offering a glimpse of relief to consumers and policymakers alike. The Consumer Price Index (CPI) rose at a slower pace than in previous quarters, with year-over-year headline inflation settling around 3.2%1. Core inflation, which excludes volatile food and energy prices, also reflected a downward trend, indicating that price increases were gradually becoming more contained across various sectors. The trouble spot continues to be shelter, which has a natural delayed effect. Inflation ex-shelter has been trending below 2% for about a year1.

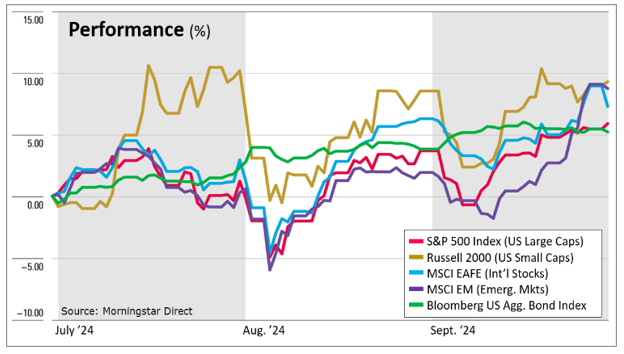

Global stock markets experienced a blend of volatility punctuated and period of enthusiasm. Investor sentiment was heavily influenced by macroeconomic indicators, interest rate speculation, ongoing geopolitical tensions, and election shocks. Slowly, one by one, developed markets’ central banks began cutting rates, with the US Federal Reserve announcing its first rate cut in mid-September. Major indices, such as the S&P 500, Dow Jones Industrial Average and the NASDAQ, saw fluctuations, but ultimately closed the quarter with modest gains as investors digested mixed earnings reports and economic data.

The much-anticipated rate cut finally gave smaller companies an edge over large stocks. Lower rates translate into lower borrowing costs, vital to small company expansions. Further, mega-sized tech stocks lost ground due to the shift in investor interest and concerns of frothy valuations.

Geopolitical developments, particularly in Europe and Asia, further impacted market dynamics. Tensions surrounding trade agreements and sanctions prompted investors to reassess risk in their portfolios. Emerging markets showed signs of resilience, driven by improving domestic economic conditions. However, the quarter ended with a sense of caution as investors prepared for a potentially turbulent Q4, with upcoming elections and economic reports expected to shape market trajectories in the months ahead.

In Q3 2024, fixed income markets were characterized by a cautious but stable environment, with bond yields reflecting investor sentiment around inflation and interest rates. Rate cuts finally happened late in the quarter. As it became clear that September would mark the first rate cut, bond prices were pushed higher in anticipation of this event. This brought returns to the positive side for 2024 as market participants weighed the implications of economic data and the potential for future rate adjustments.

Overall, high-yield bonds added to their positive performance, yet credit quality concerns emerged, particularly in sectors sensitive to economic cycles, such as energy and consumer discretionary. While some investors were drawn to the higher yields offered by junk bonds, others remained wary of potential defaults amid a changing economic landscape.

CONCLUSION

The third quarter of 2024 can best be summarized as newsflash-induced volatility. Interestingly, the third quarter’s ups-and-downs were mostly a return to normalized volatility. The subdued volatility of the first half of 2024 improperly conditioned investors. News, data, information and gossip from different domains surprised investors. The overwhelming driver was Fed action forecasts as market watchers attempted to be declared the rate cut seer champion. Irrespective of the rate cut size or timing, the Fed has declared victory on inflation and is in the process of removing themselves as the market’s focal point. The rotation from mega-cap tech names to a broader rally gives us some confidence that equity markets are becoming a bit healthier, yet we’re mindful of frothy large-cap stocks. Recent calls for asset allocation’s demise are not new, a prediction repeated for decades. The third quarter’s reminder is asset allocation is as pertinent today as when it was first developed in the 1950s, reinforced by research and studies since.

1 Bureau of Labor Statistics, bls.gov

The opinions expressed are those of Heritage Financial Consultants and not necessarily those of Osaic FA S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Russell 2000 measures the performance of US small cap stocks. MSCI EAFE measures the performance of large and mid-caps of developed markets excluding the US and Canada. MSCI EM measures the performance of the large and mid-caps of emerging market equity securities. Bloomberg US Aggregate Bond index measures the performance of US investment grade bonds, including Treasuries, government agencies, corporates, MBS and ABS. CRN-7078270-100124

Recent Comments